A Buyer’s Guide to Automated Tax Compliance Software

Tax Automation makes the tax process more efficient and less error-prone by streamlining the tax compliance lifecycle from start to finish. This includes tax preparation, calculation, and reporting. It has become less of a want and more of a need as companies face the wave of industry experts retiring with no backfill and as tax laws and regulations continue to change and grow in complexity.

Evolution of Automation in Tax Processes

The evolution of automation in tax has been a transformative journey. Over the past few decades, technological advancements have revolutionized how tax processes are managed and executed. Initially, tax preparation relied heavily on manual calculations and paper-based forms, a time-consuming and error-prone endeavor. The birth of spreadsheets in 1985 significantly advanced how data could be organized and manipulated at the click of a mouse. Spreadsheets ruled without a worthy opponent until advanced software solutions started to enter the arena.

Complex software is now luring tax teams away from spreadsheets with promises of intelligent data transformation, significantly reducing the manual effort required for tax compliance. This has simplified repetitive tasks like data entry, reconciliation, and report generation, freeing tax professionals to focus on higher-level strategic initiatives. The tax landscape continues to be reshaped by advances in technology.

Top 5 Drivers of Tax Automation

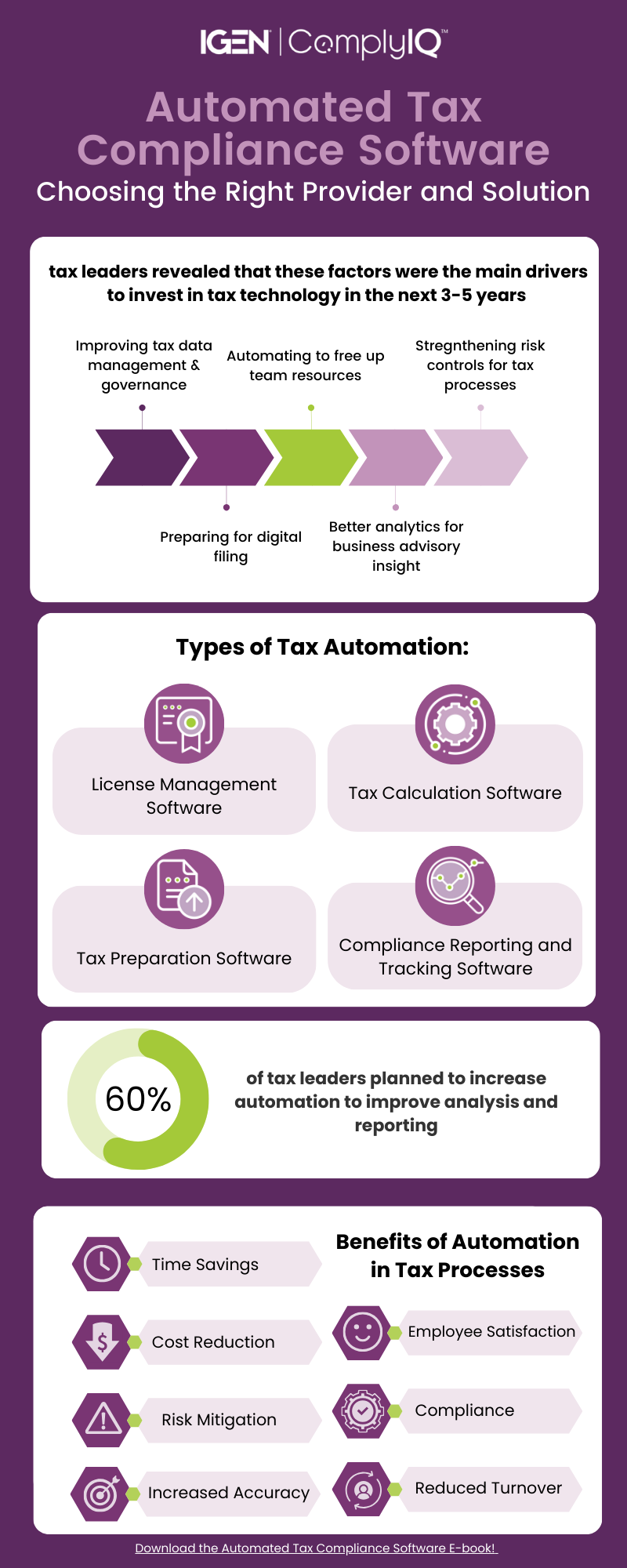

An industry survey of tax leaders revealed that these factors were the main drivers to invest in tax technology in the next 3-5 years.

- 46% said impoving tax data management and governance

- 45% said preparing for digital filing

- 44% said automating to free up team resources

- 41% said better analytics for advisory insight throughout the business

- 40% said strengthing risk controls in tax processes

These factors collectively are driving the adoption of automation in indirect tax, enabling businesses to navigate the changing tax landscape more effectively. There are also a handful of benefits that are enticing the industry towards automation and overall digital transformation.

Benefits of Automated Tax Compliance Software

Large and small businesses are incorporating automation into their workflows, and for good reason.

Tax directors discussed how they hope to evolve the indirect tax function into a more strategic role. When asked about their five-year goals, more than 60% planned to increase automation as a way to improve the analysis and reporting.

Don’t worry if you haven’t thought about tax automation, you haven’t missed the train yet. Below, we dive into more benefits automating your tax process.

Accuracy:

Automation in indirect tax significantly enhances accuracy by streamlining complex processes throughout the compliance lifecycle. With automation, tax calculations, tax preparation, and reporting become highly precise, minimizing the risk of human error and penalties.

Time Savings:

Automated solutions shine because they can complete repetitive processes quickly and effectively! An example is the ability to extract, transform, and load a high volume of reports quickly, saving time and resources. This is particularly beneficial for businesses that file many tax returns monthly. Imagine the initiatives that get pushed to the back burner that your team can finally focus on once these manual efforts are automated.

Cost Reduction:

We know the executive team loves to talk about cost reduction! A recent tax survey revealed that Over 60% of businesses experienced tax audits in the 2022, with one-third having six or more. Additionally, 40% incurred penalties, and one-third of those had values of over $50,000.

Keep in mind, federal, state, and local jurisdictions all drive the audits for monthly, quarterly, and annual reporting.

By automating the tax compliance lifecycle, businesses can mitigate risk and reduce the costs associated with manual compliance, such as the hiring of additional staff or the penalties and fines that come with filing late or incorrectly.

Compliance:

Compliance is the name of the game in indirect tax. If you don’t have to worry about staying compliant constantly, that is a huge competitive advantage! Automated solutions can stay updated on the latest jurisdiction changes and update their formulas to ensure preparations, calculation, and reporting is done effectively.

Risk Mitigation:

You can breathe a sigh of relief when you automate your tax process. Automated tax solutions can alert businesses to potential compliance issues or discrepancies in real time, allowing for corrective action before they become significant problems.

Employee Satisfaction and Reduced Turnover:

Turnover is painful in a highly specialized industry like indirect tax. A company’s best asset is its people. Automation helps retain talent by reducing manual efforts and giving team members time to accomplish tasks they prefer, like tax analysis.

Finally, team members can take vacations without guilt or anxiety of coming back to a nightmare after taking a few days or a week of leave. This boosts employee morale, work-life balance, and decreases burnout.

Types of Tax Automation Software

Automation will look different to every business depending on that business’s goals and processes. Here is a list of some types of tax automation on the market today:

License Management Software

Maintaining and updating your own licenses can be a burden, not to mention maintaining all your customer and vendor licenses. Failure to maintain license information could result in fines and penalties. In severe cases, your business license could be suspended or even revoked in certain jurisdictions. This is a huge risk.

Premium License management software alleviates the stress and time of manually entering and updating customer and vendor records. Here’s how it works:

-

Alerts you to canceled, expired, or new licenses

-

Sends automated emails to team or counterparties about upcoming renewals with a generated list of company representatives for those renewals

-

Validates licenses in real time

-

Bulk imports company records and license lists by jurisdiction

-

Stores company information that is easily accessible and updated

-

Exports license information in a platform-neutral format

Automating your license management allows you to take control of your licenses by digitally transforming your process.

Tax Calculation Software

Calculating indirect tax is difficult, especially because jurisdictions constantly change their regulations. Developing a back-end solution to calculate tax correctly is one roadblock that many teams face. IT teams and outsourced developers may have to get involved. The frequent rate changes, new acquisitions, and wide range of products are all factors that contribute to the complexity.

A premium automated tax calculation tool connects to your back-office system. It automatically calculates taxes, whether excise or sales tax, based on industry-specific programming.

The magic happens when tax analysts can sit back and focus on other initiatives because the automation updates when local, state, and national legislation changes, automatically. It recognizes weight/volume and value-based tax rate changes, making staying compliant easier than ever.

Tax Preparation Software

Tax preparation is cumbersome for many tax teams, especially in indirect tax. Most compliance data rely on manual manipulation, which is prone to human error.

Preparing tax with a high-caliber solution allows you to accurately extract, transform, reconcile, and file at the push of a button. That’s it. The days of having to put raw data through an SQL, and then send to another third party to create an e-file is over! This revolutionizes the tax compliance journey by increasing efficiency and gifting valuable time back to tax teams.

Compliance Reporting and Tracking

You can think of an automated compliance reporting and tracking solution like a filing calendar on overdrive. It’s your one-stop shop for ensuring everything is filed on time. A top-tier reporting and tracking solution will have three buckets to help you in your reporting and tracking: filing calendar, task management workflow, and performance dashboard.

-

Filing Calendar

Tax calendars are a necessity for tax teams. They highlight upcoming filing due dates and actions associated with them. Most filing calendars stop there. Digital transformation happens when these due dates and actions are woven into team task management and performance reports throughout the compliance lifecycle.

-

Task Management

As we mentioned above, premium reporting and tracking software contains task management capabilities, like alerts for internal and external due dates.

For example, as a filing date approaches, the system implements escalating alerts. The first alert may be to the tax team member responsible for filing. As the date gets closer and the report isn’t complete, the next alert will go to the team member and the tax manager. As the deadline creeps ever closer without a completed report, the alert escalates higher to the CFO, tax manager, and team member. These alerts help ensure filings are completed and penalties are avoided.

-

Performance Dashboard

The performance dashboard is the tax manager’s crystal ball into their team’s operation. It allows complete visibility into critical statistics like timeliness of completion, number of filings, amount paid, team member workload, and more.

Exclusive access

A Buyer’s Guide to Automated Tax Compliance Software

Discover how tax teams are implementing automation in their processes to achieve employee retention, cost savings, risk mitigation, and more!

5 Things to Look for in an Automated Tax Compliance Software Provider

Businesses are turning to automated tax compliance software to streamline their tax processes. With a multitude of options available, it's important to understand what components to look for in a software provider and solution. Here are a few things to add to your checklist.

Adaptability to Back-office

Compatibility with a back-office system is essential in excise tax software as it ensures seamless integration between tax management and the core financial functions of a business. By integrating automation with the back-office system, organizations can streamline data flow, eliminate manual data entry errors, and maintain accurate records.

Expertise and Support

Don’t skimp in this area. When tax-related challenges emerge, a proficient and responsive support team can significantly reduce potential risks and your blood pressure. In the excise tax industry, where timeliness and compliance are of great importance, the need for dependable support stands as a crucial foundation for a thriving tax automation solution. You want to sign on the dotted line knowing that if you have a problem, it will be addressed swiftly.

Full Compliance Lifecycle Capabilities

Having one solution for your entire tax compliance lifecycle simplifies the management of processes by providing a cohesive platform for all you tax needs. This eliminates the complexity and potential errors when using multiple systems simultaneously.

Time to Value

We can’t stress this enough. Ensure you fully understand how long the onboarding is when signing up for a new software solution, especially in the complex industry of excise tax. We’ve seen customers get burned by having the onboarding period take over two years to get running, and the implementation price was much more than originally anticipated.

Make sure to ask about time to value. The quicker the onboarding and implementation process, the quicker you will see results!

Total Cost of Ownership (NOT Price)

Price is always a factor when considering software vendors. However, the more important number is total cost of ownership. Why? Because flat price doesn’t include a variety of other expenses related to purchasing software. If you don’t think about total cost of ownership, your budget will not accurately reflect the investment you’re about to make. Also, price comparisons for vendors aren’t going to be very helpful if you’re not comparing apples to apples.

Make sure you include:

- Full subscription cost

- Implementation/onboarding cost

- Training costs

- Maintenance costs

These points will help give you the full picture. It might also be helpful to investigate the cost of other software you may need for transforming data and supporting audits and assessments if it is not included in the solution.

5 Common Objections to Automation (with Rebuttals)

Automation has rapidly transformed the tax landscape, gifting unparalleled efficiency. Yet, this has not been without its fair share of skeptics and naysayers. Here are some common objections to implementing a automated tax compliance software.

“Robots are going to steal my job”

Some may picture the apocalyptic movie iRobot when thinking about automation. AI and intelligent programs are great for repetitive tasks but couldn’t replace the human element of strategic and ethical thinking.

Don’t think of automation as the villain. Instead, think of it as your trusty sidekick whose superpower is completing repetitive responsibilities accurately and quickly for your benefit and bringing value to the business.

You can say: Rather than stealing your job, it frees up your calendar for more complex and strategic tasks and gives you the opportunity to finally take that vacation!

“This solution is too expensive”

Why juggle and manage multiple technologies when you can master one that checks all your boxes? Seems like a no-brainer, but some companies opt to use multiple technologies because they believe it saves money. However, a singular comprehensive solution can be more cost-effective in the long run.

You can say: This is everything we need in ONE solution and it will pay off in the long run because it requires fewer licenses, training resources, and maintenance efforts compared to having multiple systems.

“We don’t have the time to train employees and manage this”

Introducing new software takes an investment of time and resources in training employees to use the new tools effectively. This training period can disrupt regular workflow and productivity, causing apprehension among staff. Additionally, effective transition management is crucial for ensuring a smooth implementation. Instead of writing off new technology advancements because of this fear and annoyance...

You can say: The right vendor will handle most of the onboarding so the change is limited to initial data provision, data knowledge transfer, and training once configuration is complete. This is a short-term investment for a long-term gain.

“I don’t like third-parties they are a black box”

Black boxes are impossible to see through. Some third parties are the same way. They will take your data and spit out the data you are looking for, but you have no clue what was done to get that final result. So, it would be hard to troubleshoot any issues and explain tax calculations or other data that went through the software. Ideally, the more visibility into the inner workings of a program, the better. This promotes layers of understanding and trust in the solution.

You can say: We considered visibility when searching for a tax solution and we are able to extract everything we need with this technology.

“Working with a vendor comes with risks”

Vendor risk can present a notable objection to implementing new software, especially if you’ve been burned in the past. When businesses consider integrating third-party software, they expose themselves to the potential vulnerabilities associated with the vendor's reputation, security practices, and reliability. This can feel scary to stakeholders, especially the IT team, that’s why it is so important to do your due diligence in the initial prospecting stage.

You can say: We took this into consideration during the prospecting process and feel confident in our vendor agreement!

How to Get Buy-In for Automated Tax Compliance Software

Once you have your heart set on a particular software provider, you must get buy-in from your team, management, and executives. Getting buy-in for tax automation software can be a challenging process, but the short-term pain is worth the long-term efficiency. Here's a list of strategies to help you get buy-in.

Preparation is the Foundation

Success starts with good preparation. A prepared mind is a powerful asset. Start with an analysis of your current processes today and note where there are bottlenecks or areas that need improvement. Then, show how the technology can solve those problems and the ROI associated with it.

You can highlight the benefits of the technology by crafting a clear and concise proposal that outlines:

- Technology features

- The potential impact on current processes

- Cost-benefit analysis

- Case studies and real-world examples from similar organizations

Have a clear understanding of the objections you might face and have data-driven rebuttals prepared.

Get Your Stakeholders on Board

Before you propose the new technology to the ultimate decision-maker, unite your main stakeholders and get them on board. This helps give you diverse perspectives and unites the collective toward a common goal. This may include your other tax team members, your IT team, or your operational team. Here are some tips for getting your stakeholders on board.

Understand the Stakeholders

Categorize your stakeholders based on job function. Try to understand their unique concerns, motivations, and how the technology will impact them.

Tailor your message

Depending on the group you pitch to, you will want to tailor your messaging to resonate with them. For example, for the tax team, this could be a reduction in repetitive time-consuming manual work. For the finance team, this could be cost savings from reduced penalties and fines. Paint a picture of what their future could look like with the adoption of automation.

Demo the Technology

Block some time to demo the technology with the stakeholders to show them the platform and its key features. Seeing the technology can help build confidence and buy-in. This is a great time to address any key concerns.

Make Your Case

This is the moment all your preparation will (hopefully) pay off. The ultimate decision-maker might be the CFO or CEO. They care about data and the company’s bottom line. Focus on how the new technology has immediate and long-term advantages like employee retention, less costly manual errors, and increased productivity. Align these benefits with the overall goals of the company so it aligns with the broader strategic vision.

Subscribe now for tax compliance insights

Don't forget to share this post!

VP of Revenue