E-Cig Tax Compliance

Vape tax software for e-cig distributors & wholesalers

Have you solved for tax compliance?

Turn the challenges of new regulations into a long-term strategic advantage, continue business with minimal interruptions, rapidly comply with new regulations with vape tax software.

Trusted by Industry Leaders

Join teams that reduce risk, save time, and increase accuracy in compliance. Read their stories here.

A New Way to Comply

Finally, a vape tax compliance platform that actually helps you reduce risk, minimize cost and elevate your tax team.

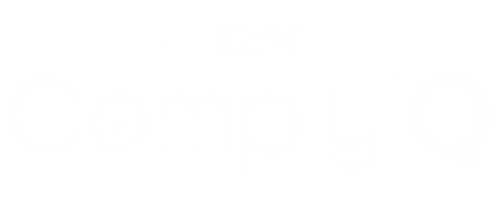

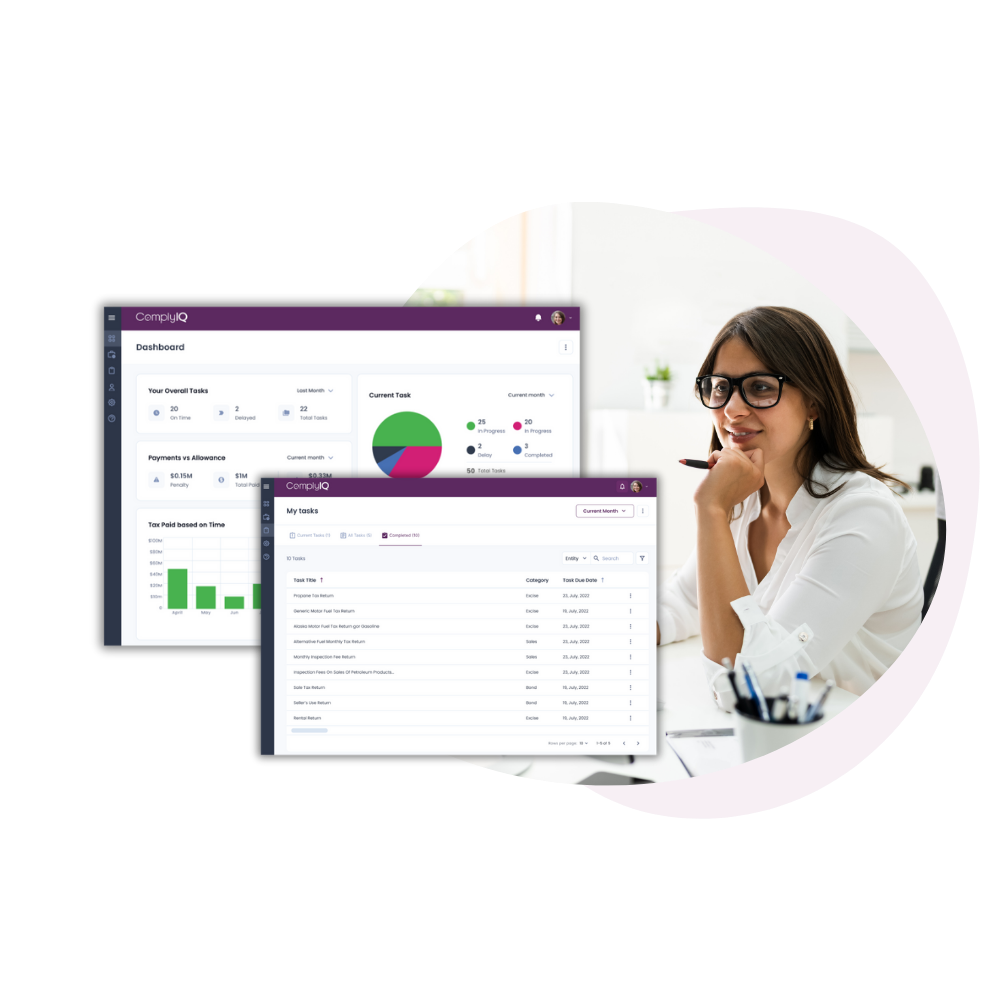

Solve PACT reports for vapor & e-cig products with ComplyIQ

Reduce the time and resources spent on PACT and get back to business. Automate PACT reports for all 50 states with our all-inclusive solution. We build and maintain your PACT reports using each state-required form, so you don't have to. Plus, hosting and onboarding are included in our flat rate.

Get licensed and registered to sell vapor products

Our trusted legal partners will work with you to analyze your business operations and identify where you need to be licensed and registered. Plus, they can assist you with registration and obtaining those licenses including:

- PACT Act registration with the Bureau of Alcohol Tobacco and Firearms (ATF),

- PACT Act registration with all applicable states and obtaining registered agents

- Licensing for state regulatory compliance where applicable for sales and excise tax

Solve licensing and registration for vapor and e-cig products, and get back to business.

Free E-Course

Building your plan for PACT, licensing & reporting

Get started on a compliance plan. Understand reporting requirements for PACT & excise taxes. Know what to expect from state licensing. Figure out what to look for in excise tax systems.

Tobacco and vape excise taxation: a comprehensive guide

Download our free guide and dive into the details of excise tax in the vapor industry, why it can be challenging, and how it impacts the day-to-day business of tax teams.

Your guide to calculating taxes on vapor products

Taxing vapor products, e-cigarettes, and even components sold separately from the solution is complicated. Get informed with our guide to calculating and collecting tax on vapor products.

We dive into how vapor products are taxed, review the risks your business faces when taxing vapor products, and break down the costs and resources you'll need to build your own vape tax calculator.

Tax on tax: understanding excise & sales tax for vapor products

Our tobacco tax experts and former state auditors, Chris Roy and Jeanne Thompson, join Sovos' Daniel Kostrzewa to discuss the challenges tobacco and vape companies face in their excise and sales tax compliance processes.

2024 State Tax Changes in Tobacco & Vape

Access our comprehensive 2024 state tax changes report for an in-depth look at legislation affecting cigarette, tobacco, and vapor tax compliance this year.

Get Started

Talk to An Expert

To get started with ComplyIQ, powered by IGEN, simply fill out the form below or give us a call at 888.998.4436. Reach out to us today to talk to an expert.