Leverage excise tax software built for complex data

Our excise tax software is designed around a data engine, letting you unload the hassle of excise tax return preparation and filing.

Simplify indirect tax filing & more

Use ComplyIQ by IGEN to prepare data, generate forms & e-files, and file accurately with reporting entities.

The teams behind indirect tax reporting

Working with ComplyIQ by IGEN has been a great decision my company has made. It allows you to have complete visibility of the data flow from beginning to end. It has helped us tremendously in identifying data issues faster and makes the processes transparent for our compliance data. IGEN has empowered my team to troubleshoot data issues and identify areas of improvement with their workflow design. In addition, their support team is always ready to help in a timely manner.

Automate form generation with excise tax software

Complex businesses need excise tax software that’s flexible enough to handle changing business lines, regulations, and data. Our form generation engine is built around a data engine, so you can:

Increase Filing Efficiencies up to 87%

Reduce Time Spent Preparing & Filing Returns

Reduce Risk of Inaccuracies

Leave endless data preparation, monotonous filing tasks, and time-consuming audit defense behind. Say hello to intelligent tax compliance in one transparent platform.

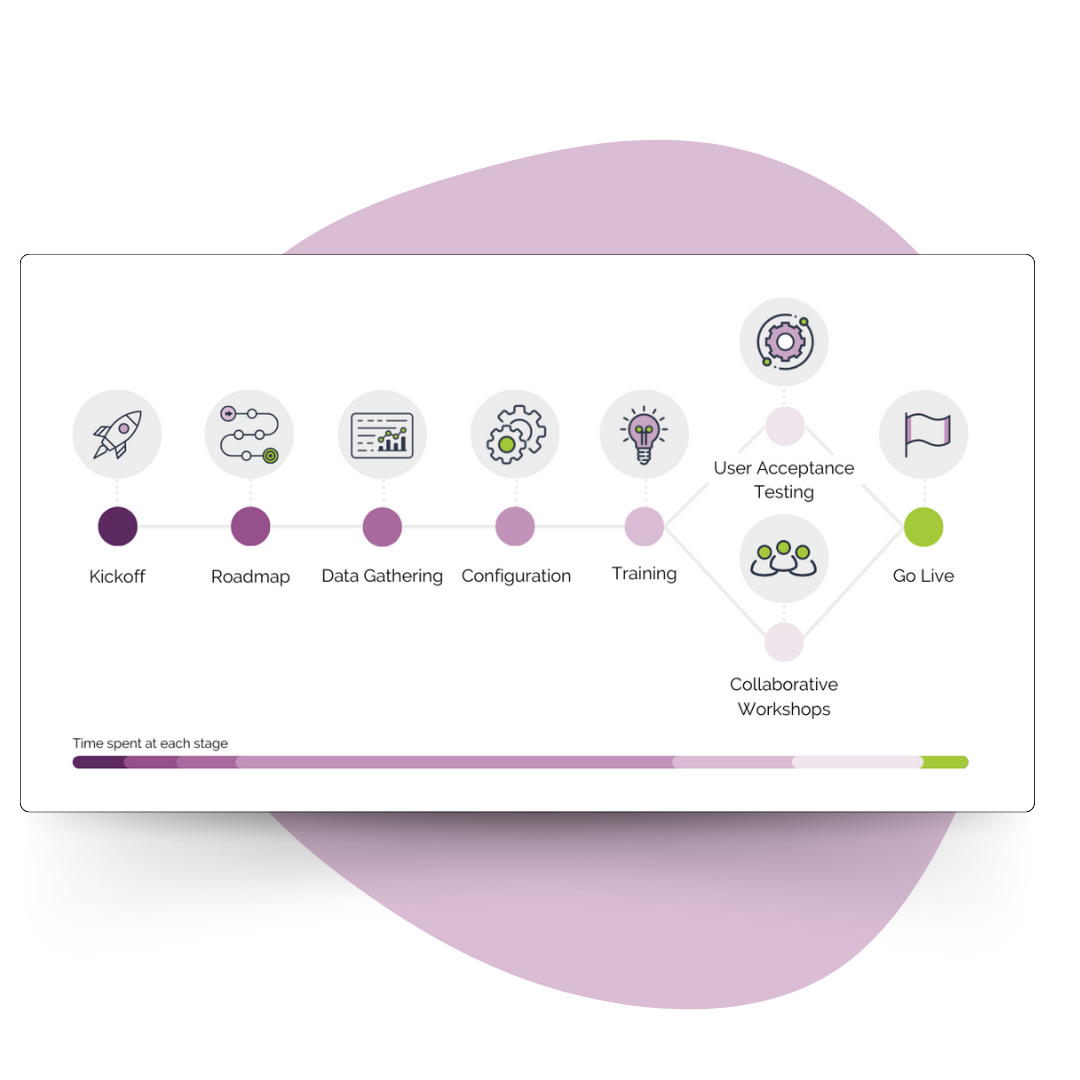

Get the fastest time-to-value in the industry

Accelerated Onboarding

Our dedicated onboarding team will navigate you through each stage of your onboarding. From project kickoff to comprehensive user training, you can expect a smooth transition from your current filing process.

Client-Powered Onboarding

Come alongside us, configure your own returns, and gain all the necessary skills to manage and scale the ComplyIQ platform for your business.

Transform your data with ease

Data Import

Easily import your excise tax data into ComplyIQ to create a single source of truth.

Data Engine

Ensure your data is accurate, complete, and formatted correctly. Identify unexpected errors, correct those issues, and create automation to resolve similar problems next time.

Visibility into the compliance lifecycle

Visual Workflow-Builder

Configure your reporting process into a visual workflow that allows you to see progress in real-time.

Flexible Architecture

Build & test schedule criteria in a flexible, user-maintainable environment.

Defend audits with peace of mind

Transaction Tracking

Track each transaction from its introduction to ComplyIQ, all the way through to its presentation on the form or e-file.

Audit Period Data

Quickly pull all data for an audit period using our proprietary data tools.

Resources

Automate Tax Compliance

Help your business do tax preparation & filing right, with ComplyIQ by IGEN. Talk to an expert today.