Data Orchestration for Tax Compliance

4.8/5 stars for client support

Aggregate, combine, and enhance complex data sets to produce clean, accurate data for compliance operations. This data orchestration tool is your one source of truth for complete and transparent data preparation.

Schedule a call

Leverage a data integration tool built for tax & compliance

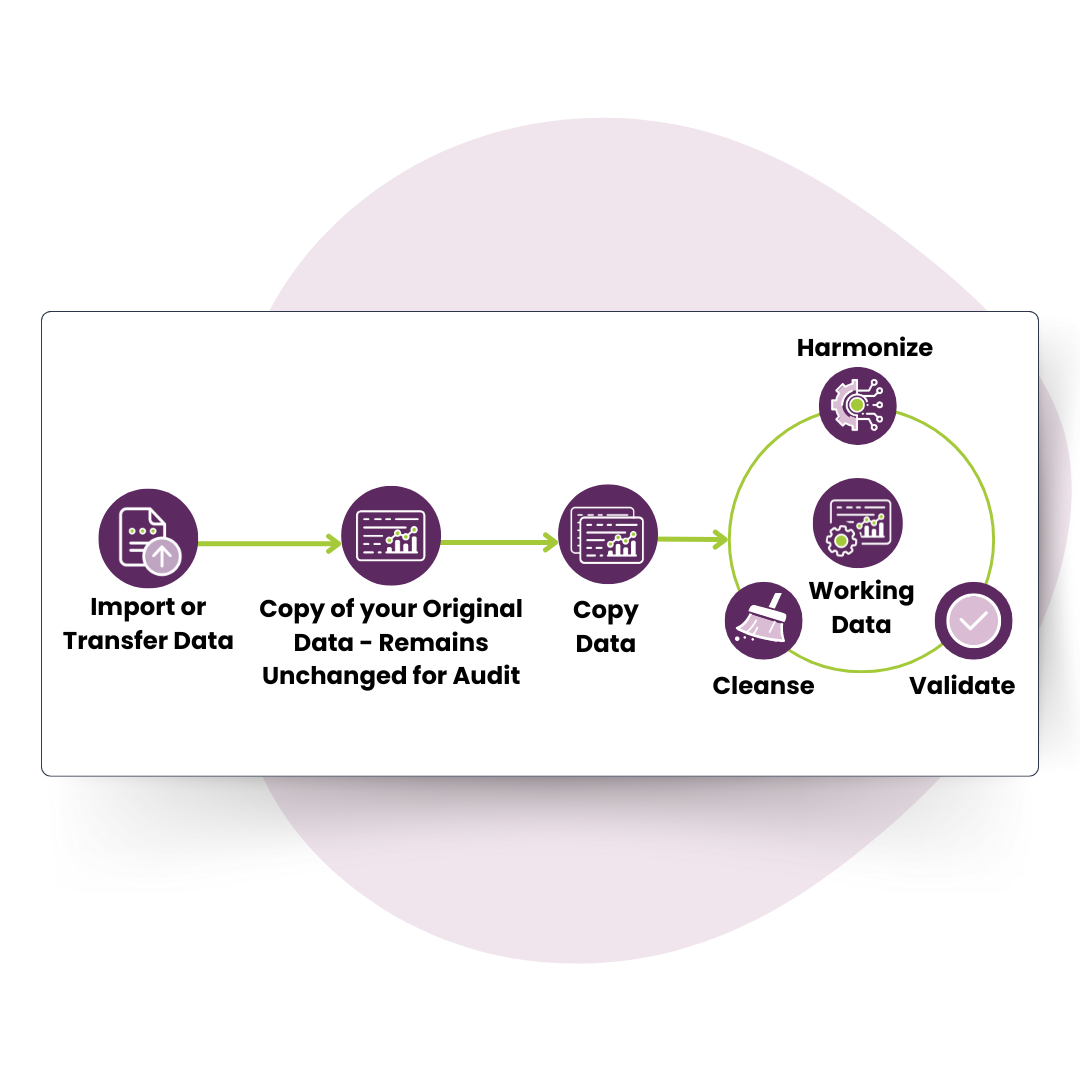

Our data orchestration software is the core of our compliance platform. It allows you to import, load, and transform raw data into your one source of truth for clean, accurate compliance data.

Simplify indirect tax data preparation

Most compliance data preparation depends on manual manipulation, often siloed outside of tax, which leads to poor data quality, rejections, amendments, and, eventually, audits. Use ComplyIQ by IGEN for data orchestration.

It’s not manual data manipulation, it’s intelligent data transformation

Complex businesses need a data engine that’s flexible enough to handle changing business lines, regulations, and data. Unlike most other tax software, our data orchestration tool is built around a tax engine, so you can:

Gain Visibility Into Your Data

Reduce Time Spent Preparing Date

Increase Filing Efficiencies

Leave manual data manipulation, siloed outside of tax, behind. Say hello to intelligent data transformation in one transparent platform.

Transform complex data

Robust Data Engine

Ensure your data is accurate, complete, and formatted correctly. Identify unexpected errors, correct those issues, and create automation to resolve similar problems next time.

Workflow-driven process automation

Mirror Your Existing Process

Build workflows to mirror your current compliance process and data preparation procedures

Replace Manual Tasks

Create repeatable processes to completely replace manual data manipulation tasks

Configurable to Your Business Logic

Use pre-configured widgets or personalize no-code widgets with your unique logic to accomplish tasks such as loading data, cleaning data, and more

Save Standard Operating Procedures

Add steps, notes, and other requirements into the flexible workflow architecture to securely save your SOP documentation directly in the platform

Resources

Automate Tax Preparation

Help your business do data transformation right, with ComplyIQ by IGEN. Talk to an expert today.