Maintaining and Preparing Tax Data in Tobacco

Excise tax preparation in the tobacco industry presents unique challenges due to the complex nature of the products and the regulatory environment. We discuss some challenges, offer insights, and provide strategic recommendations to navigate this intricate landscape successfully. Below are some of the challenges companies face when maintaining and preparing data in tobacco.

Tax rates

Everchanging tax rates come with the excise tax industry. This becomes a challenge when doing business in multiple states and jurisdictions. Preparing data in tobacco can feel like playing musical chairs; one moment, you think you have it figured out, and the next, you are left scrambling.

Some states are great at publishing their changing regulations ahead of time like Colorado releasing their tax rate updates until 2027.

Others are not as forthcoming and could leave you with little chance to make changes.

This is why it is so important to be proactive in seeking regulation changes and have a process to modify data and formulations efficiently.

Gathering and maintaining product attributes

Tobacco products have a complex tax structure, jurisdictions reclassify tobacco products and group new types of tobacco products continuously. This creates different rates for products like cigarettes, cigars, and smokeless tobacco. Getting more granular, two similar kinds of tobacco products could be taxed and priced differently because of weight or quantity.

For example, cigars and cigarillos are similar tobacco products subject to different tax rates. Both are tobacco products that are designed for smoking; they look the same, but they differ in size and weight. The specific distinction between these two types of products results in different tax liabilities.

Keeping up to date on tobacco regulations is essential for data quality and integrity. If you have the wrong price or tax category, that will impact your preparation and calculations, which could trigger an assessment, penalty, or audit.

Manual Data Manipulation

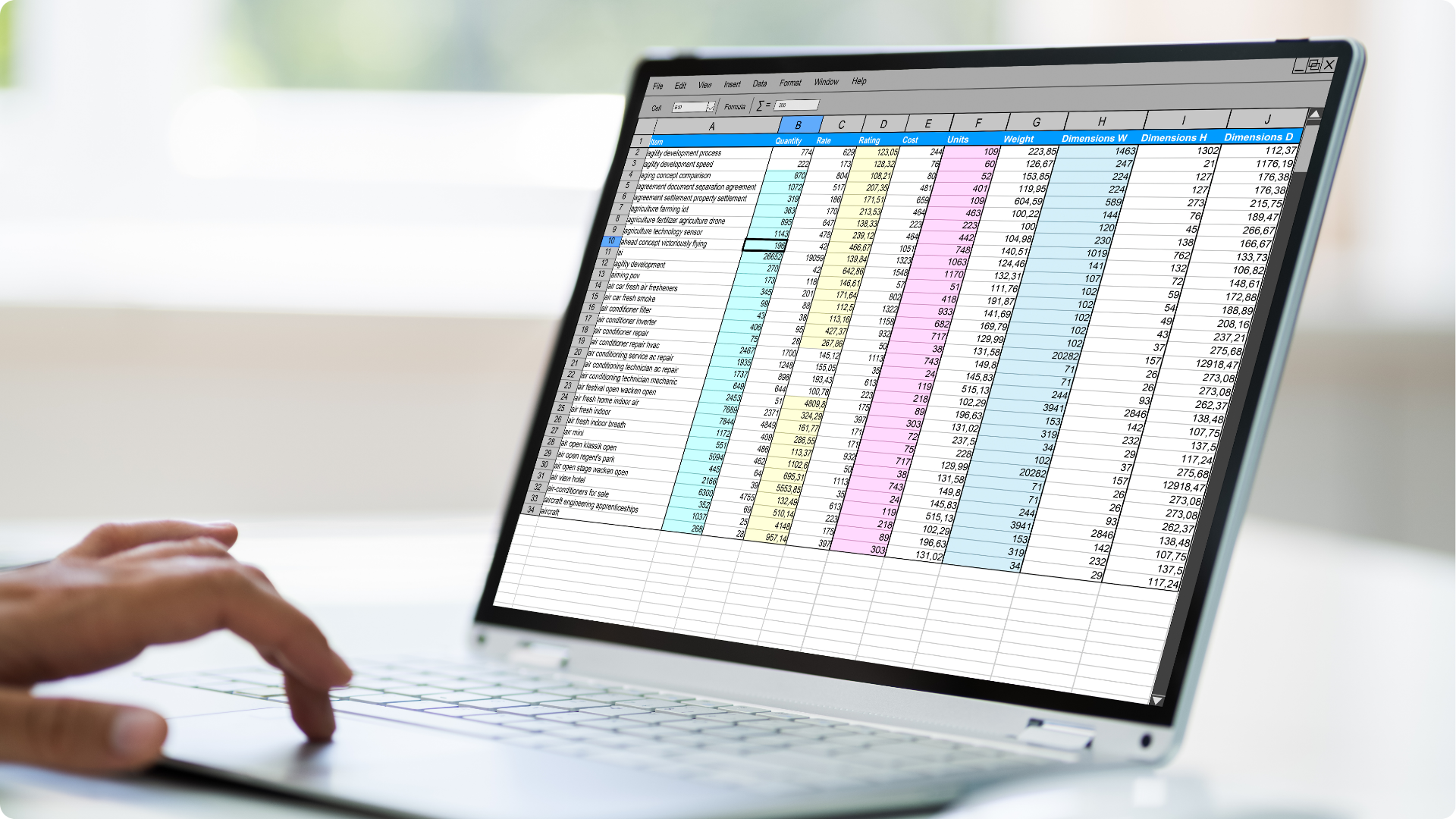

The hard truth is that not all data is created equally. Some data has more touchpoints that could lead to questionable data integrity. Anytime you manually manipulate data, there is a risk of human error, especially if you manually manipulate large datasets in a spreadsheet.

Forbes reveals that 88% of spreadsheets contain errors.

Errors may arise if one is not cautious while handling tasks such as manipulating cells and formulas, inputting data, dealing with typos, or neglecting to save changes to new versions.

The goal is to detect errors proactively, preventing them from resurfacing during assessments or audits. This task can be challenging during the data preparation stage, even when there is confidence in the accuracy of the initial data entry because of the time-heavy task of manually sorting, cleaning, and preparing the data.

Data uniformity

Consistent data formatting can be challenging, especially if multiple stakeholders are involved.

This can come down to something as elementary as having Saint Edmunds formatted as St. Edmunds, this small variation can cause a filing rejection.

You can see how uniformity throughout your data is crucial to data preparation and filing. Uniformity helps your back office go from a metaphorical messy room to a clean and organized one.

Ways to Alleviate Data Prep Challenges

Automation

Automation is pivotal in alleviating data preparation challenges, especially in industries like tobacco, where data can be voluminous and subject to frequent changes. Automated data preparation tools streamline processes by handling routine tasks such as cleaning, formatting, and transforming data, saving time, and reducing the risk of human error.

In fact, 41% of errors in reporting were attributed to human error.

By minimizing manual intervention, automation empowers data professionals in the tobacco industry to focus on higher-level analytical tasks, enhance the accuracy of results, and navigate the complexities of an ever-evolving data landscape with greater efficiency.

Data Cleaning

Data cleaning involves identifying and rectifying errors, inconsistencies, and missing values within datasets, ensuring that the information used for analysis is accurate and reliable. Effective data cleaning becomes paramount in tobacco, where regulatory changes, product variations, and dynamic tax rates are prevalent.

Intelligent ETL (extract transform load) is a great software tool to clean and transform data transparently for compliance. In fact, ETLs can increase filing efficiencies by up to 75%.

Standardize Formats

Establish uniform data formats for dates, numerical values, and categorical variables during the data entry and preparation phase. Ensure this standardization permeates every facet of your operation. This way, consistently formatted datasets will make adhering to unique jurisdictional requirements easier.

Stay Updated & Connected

This may seem like a no-brainer, but staying up-to-date can sometimes get put on the back burner when your team is understaffed or struggling to find additional time in their day.

Staying informed about the latest regulations in the states and jurisdictions where you conduct business is crucial. Consider joining a distributor’s association in your state to stay updated on trends and upcoming legislative changes.

Additionally, participating in industry forums and networking events can provide valuable insights into regulatory shifts and best practices. Leveraging these resources ensures you stay proactive in adapting your business strategies to compliance requirements.

Best Practices for Preparing Data in Tobacco

Create a Comprehensive SOP

Document the data preparation process and keep clear records of the steps taken during data preparation, including any decisions made, key stakeholders, and data cleaning procedures. This will be the foundation for your Standard Operating Procedure (SOP), which will help guide your team when maintaining and preparing data. Comprehensive SOPs ensure consistency and accuracy in processes, providing a clear roadmap that minimizes errors and enhances overall operational efficiency. They are vital tools for maintaining compliance, mitigating risks, and promoting organizational best practices.

Internal Audit

When was the last time you did an internal audit? Depending on the size and complexity of your business and operations, internal audits could be beneficial every quarter, twice a year, or annually.

An internal audit involves a thorough review of financial records, transactional data, and documents related to tobacco tax liabilities. This process helps identify discrepancies, assess the accuracy of calculations, and ensure adherence to specific tax regulations in the tobacco sector.

Keep in mind RiskOptic’s 5 C’s for internal audits:

- Criteria: uncover the motivations behind the internal audit and identify the key stakeholders driving the request.

- Condition: Explore the organizational circumstances prompting the need for an audit.

- Cause: Investigate the factors that contributed to the emergence of these conditions, leading to the necessity of an audit.

- Consequence: Anticipate the potential outcomes and aftermath if these conditions go unaudited, emphasizing the importance of thorough examination.

- Corrective Action: Determine how the organization can proactively address and rectify the identified conditions based on the insights gained from the audit findings.

Beyond compliance, an internal audit acts proactively to detect and correct potential errors before they become significant issues.

Verify Return Numbers

Doing some spot-checking before submitting a return is a best practice for ensuring accuracy. Excel manipulation and pivot tables are helpful for comparing the invoices you received to the numbers on your return. Adding spot-checking into your preparation process not only enhances the reliability of your financial data but also streamlines the identification and rectification of any discrepancies, ensuring a more robust and error-free submission.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Chris Roy

Excise Tax Subject Matter Expert