Navigating Tax Risks in Indirect Tax: A Strategic Guide for Risk Management

In today's complex and ever-evolving tax landscape, managing tax risks has become an emerging concern for businesses of all sizes and industries. By addressing tax risks head-on, businesses can avoid costly penalties, reputational damage, and legal issues, ultimately achieving greater financial stability and operational success. A well-executed risk management strategy provides a solid foundation to navigate the intricacies of taxation.

Don't have time to read? Download "Navigating Tax Risks in Indirect Tax: A Strategic Guide for Risk Management" and save for later!

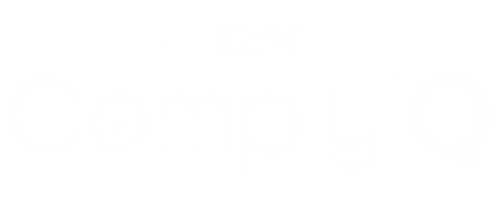

What is Risk Management

Risk management is a systematic process that identifies, assesses, prioritizes, and mitigates potential threats or uncertainties that could impact a business’s objectives, projects, or assets.

Knowing your company’s risks is crucial to a sustainable business plan. Risk management analyzes risk, including financial, operational, strategic, and compliance-related, to make informed decisions to minimize negative impacts and capitalize on potential opportunities.

How Does Tax Relate to Enterprise Risk Management

Tax plays a huge role in enterprise risk. The indirect tax laws, regulations, and compliance requirements in multiple jurisdictions nationwide constantly change. Failure to adhere to these changes can result in penalties, and fines, which all impact the overall stability of the company. Because of this, an enterprise risk management plan must encompass an assessment of tax-related risks to ensure mitigation strategies are in place and align with the broader risk management framework.

Importance of Managing Tax Risk

Managing risk in the tax vertical is crucial to mitigating financial, operational, and legal risks. Below are some important reasons why tax should be included in your risk management plan.

Long-term Financial Stability

Indirect taxes can represent a significant portion of cash outflow. Failure to manage these taxes effectively may lead to unexpected financial burdens, including penalties, interest, and fines, which can impact a company's bottom line. These penalties may also not deductible for income taxes, which can impact the profit and loss of the company.

By proactively managing indirect tax risk, businesses can enhance their long-term sustainability. This includes better preparation for tax law changes and other external challenges that may impact financial health.

Tax Compliance and Penalty Avoidance

It’s no secret that tax compliance in the tobacco, vapor, and fuel industries is incredibly complex and always changing. For instance, A new tax rate for premium cigars could be issued for one county and not a neighboring county in the same state. Non-compliance with tax regulations can result in penalties, interest charges, and additional tax assessments. Managing tax risk helps minimize the likelihood of incurring these costs, saving businesses money and resources.

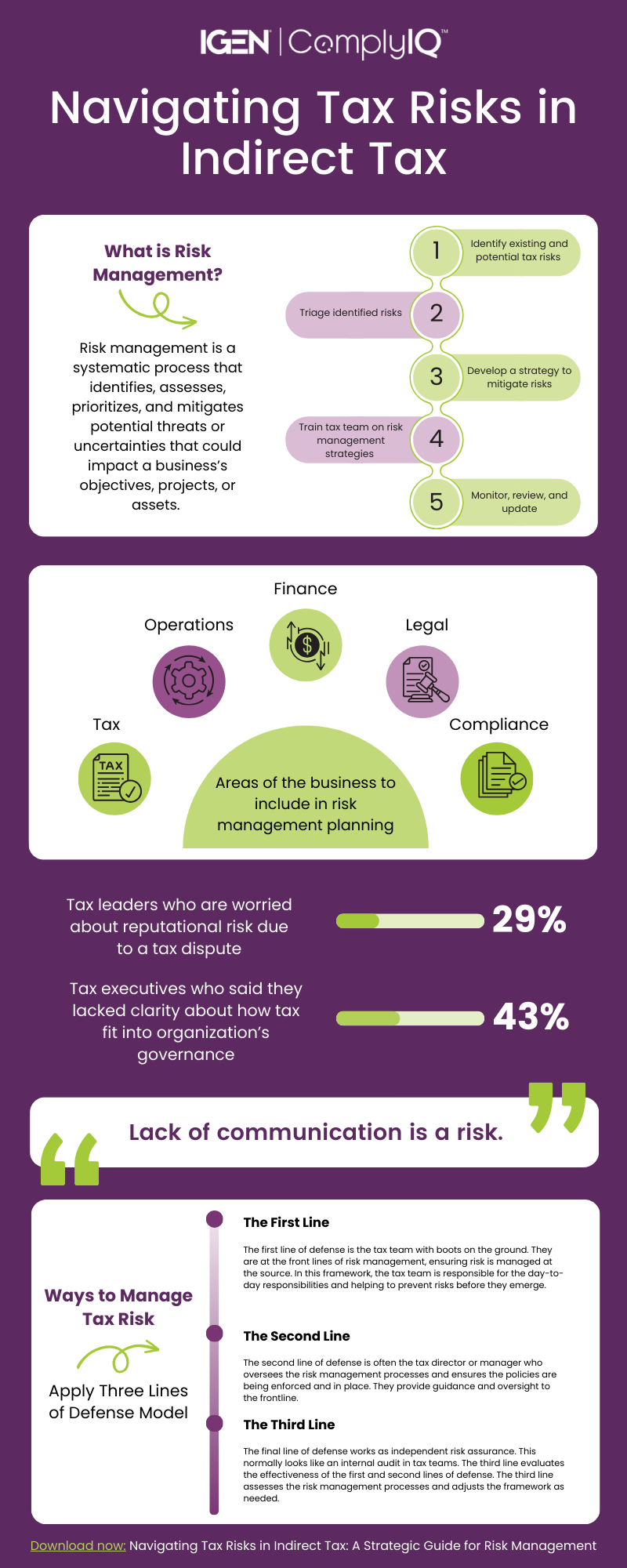

Trusted Brand Reputation

In some industries, like vapor, if you lose your license, you can't buy or sell in that jurisdiction temporarily or permanently. According to our sources, 29% of tax leaders are worried about the reputational risk to the business due to a tax dispute. Maintaining tax risk helps protect your brand reputation. When you are constantly compliant and following best practices, you establish trust with your stakeholders and customers. This, in turn, establishes your brand as having authority in the industry.

By proactively managing indirect tax risk, businesses can enhance their long-term sustainability. This includes better preparation for tax law changes and other external challenges that may impact financial health.

Competitive Market Advantage

Businesses that effectively manage their tax risk are better positioned to compete in the market. They can invest in growth opportunities and adapt to changing market conditions without being burdened by unexpected tax liabilities.

Types of Tax Risks

In tax, hearing the words “late filing” or “overpayment” can trigger a surge of anxiety, and rightfully so. Tax risks can be a domino effect. Once one happens, it is easy to trickle into other errors and impose more risk. Here are some common risks tax teams face in the excise tax industry.

Assessments

Assessments are a discrepancy that the state finds and bills you for. The more assessments you have, the higher your chance of an audit.

Audit

The dreaded audit. Audits often happen when the government catches errors or anomalies in your tax documents or too many assessments are issued. Getting audited is a huge drain on the tax team, finance team, and operational team. Audits can be exhaustive and time-consuming, and penalties can impact the business’s profitability.

Changes in Legislation

In indirect tax, changes in legislation happen all the time. To make things more complicated, changes in legislation may occur on the county, state, or national level, making it hard to stay on top of. These changes require agility and frequent changes to compliance procedures to stay compliant and mitigate risk.

Filing Errors

Filing errors could happen if you don't report transactions, have incorrect data, or upload a corrupted file. Even though this may be a small error in some instances, it could come with financial losses, trigger an audit, or increase compliance costs to correct the mistake. Accurate and timely excise tax reporting is crucial to avoid the risk of filing errors.

Incorrect Registration

Some businesses miss enrolling for registration and licensure correctly with the government, so the statute of limitations never begins, and the business starts tolling. The government can audit a tax return within the statute of limitations, which varies by jurisdiction. However, if you aren’t registered correctly and are tolling, the government can audit you further back, like seven or even ten years. This would require lots of manpower and hours digging for needed documentation.

Late Filings

If you don’t have a dynamic filing calendar or due date tracking software, a deadline could slip your mind. Especially if you are filing hundreds of returns a month. The risk of late filings could incur penalties and interest, which can result in additional financial liabilities beyond the initial amount owed.

Overpayments

An overpayment happens when the business remits more money than it owes. For example, a company that imports and sells gasoline could make some miscalculations and pay taxes on 10,000 more gallons than they sold. At a national excise tax rate of 18.4 cents per gallon, this could lead to an overpayment of $1840. To address overpayments, companies must request a refund or credit from the tax authority.

It's important for businesses to regularly reconcile their records and verify their excise tax liabilities to avoid overpayments and complications with compliance.

Tax controversy

Tax controversy happens when a dispute occurs between the business and the taxing jurisdiction. This could be when a jurisdiction serves a business with a large assessment that the business disagrees with. These disputes can be resolved in court or settled outside of court. Tax controversies are often time-consuming and expensive to the business as external legal teams may need to get involved.

Strategic guide

Navigating Tax Risks in Indirect Tax: A Strategic Guide for Risk Management

Ways to Manage Tax Risk

Develop a Risk Management Plan

The most time-consuming but important step to managing task risk is developing a comprehensive risk management plan. The IFAC has a great guide to establishing a risk management program. Here are a few steps to get you started thinking about what is needed in a comprehensive tax risk management plan:

- Identify existing and potential tax risks

- Triage identified risks

- Develop a strategy to mitigate risks

- Train and educate the tax team on risk management strategies

- Monitor, review, and update

A successful risk management plan allows the tax team to implement effective strategies and controls to mitigate risks, reducing the likelihood of costly errors or non-compliance issues. Additionally, a well-structured risk management plan enhances transparency and accountability within the team, ensuring that everyone understands their roles and responsibilities in managing tax-related risks effectively.

Apply Three Lines of Defense Model

The First Line

The first line of defense is the tax team with boots on the ground. They are at the front lines of risk management, ensuring risk is managed at the source. In this framework, the tax team is responsible for the day-to-day responsibilities and helping to prevent risks before they emerge.

The Second Line

The second line of defense is often the tax director or manager who oversees the risk management processes and ensures the policies are being enforced and in place. They provide guidance and oversight to the frontline.

The Third Line

The final line of defense works as independent risk assurance. This normally looks like an internal audit in tax teams. The third line evaluates the effectiveness of the first and second lines of defense. The third line assesses the risk management processes and adjusts the framework as needed.

The Three Lines of Defense model enhances risk awareness and transparency while also fostering a culture of risk management throughout the organization.

Have Strong Visibility Throughout the Business

It’s important for all business functions to be in sync and have visibility within each other. Encourage collaboration between the tax team and other departments, such as finance, legal, and operations. Cross-functional teams should work together to identify and mitigate tax-related risks that span multiple areas of the organization. For example, your tax team should never be left saying, “We were the last to know,” about something that impacts tax compliance, like selling in a new jurisdiction.

A role-defined task management workflow might be what your business is missing in this area. Having complete visibility into performance and tasks throughout the business helps see the full scope of work being completed and allows insight into what risks may be present.

Establish a Risk-Aware Culture

Everything should be “audit ready”. This means no cutting corners. Believe us, the extra steps are well worth it and become healthy habits the tax team adapts. By instilling a risk-aware mindset, you not only safeguard the company from potential risk but also enhance the team's ability to adapt and excel in an ever-evolving tax landscape.

Monitor and Control Risks

Dynamic tax compliance software and reconciliation technology can help monitor and identify discrepancies and anomalies in excise tax records. Conducting internal audits and exception reporting can further ensure that the excise tax liabilities match the actual business activities.

Sometimes mitigating risk includes also accepting some level of risk. This depends on how your risks are triaged in your original risk management plan. Follow your risk management processes and be sure to update when necessary. Tax laws and business environments change, so your risk management plan should be reviewed and updated regularly to remain effective.

Stay Informed on Industry Changes

The excise tax industry can feel like a whirlwind some days. Staying current on tax rate changes and new legislation requires continuous education, subscribing to industry tax updates , and consulting with peers and other like-minded tax professionals.

How to Get the Executive Team to Incorporate Tax into Risk Management Strategy

Remember, lack of communication is a risk. Tax processes should tightly align with the business’s operational functions. This helps mitigate risk from taxes that come with selling to new jurisdictions or when acquiring a new company. Unfortunately, tax teams are often put on the sidelines of enterprise-level strategy planning. Almost half (43%) of tax and finance executives say they lack clarity about how tax fits into their organization’s broader governance structure, according to a 2023 tax industry survey.

This is alarming because, without including tax in the enterprise risk management strategy, the business leaves itself vulnerable to large gaps in its framework. So how do you get the executive team to see the importance of tax and risk? Here are some strategies to encourage this integration.

Educate Executive Team

You can start integrating tax into the conversation by education. The executive team doesn’t know what they don’t know. Educating them about the impact tax-related issues can have on the organization's risk profile and financial performance can help their understanding. Highlight real-world examples of companies facing legal and financial repercussions from tax-related risks.

Align Tax Objectives with Business Objectives

Show how the tax team's objectives align with the broader business objectives and risk management goals of the organization. Emphasize that proactive tax planning can contribute to profitability and competitive advantage while minimizing risks.

Develop and Share Risk Assessment and Reporting

Develop a structured process for identifying and assessing tax-related risks. Encourage the tax team to provide reports and risk assessments in a format easily understood by the executive team. Use visualization tools to make the information more attractive and digestible.

Conducting scenario analyses that demonstrate how different tax strategies or changes in tax laws could affect the organization's financial position and risk profile would bring value to the conversation too. This can help the executive team better appreciate the potential impact of tax-related decisions.

Don't forget to share this post!

Nick Milledge

VP of Revenue