Tax Compliance Intelligence vs. Tax Calendar: What’s the Difference?

Tax and accounting departments face constant pressure to ensure timely and accurate filings across multiple jurisdictions. The tools you use can make the difference between a smooth, efficient operation and one plagued by manual errors, missed deadlines, and mounting penalties. For years, teams have relied on some form of a manual tax calendar. However, as business complexity grows and reliable seasoned experts retire, many leaders are asking if a simple calendar is enough.

The reality is that modern tax operations require more than just spreadsheet-based tracking. They demand robust workflow management, risk controls, and performance insights. This is where tax compliance intelligence enters the picture, offering a strategic alternative to a basic tax calendar. Understanding the distinction is crucial for optimizing your tax function.

Defining the Tools: Tax Calendar vs. Tax compliance intelligence

At first glance, these tools might seem similar, as both help manage deadlines. However, their scope and capabilities are fundamentally different.

Tax Calendar

A tax calendar is a system focused exclusively on tracking filing and payment due dates. Its primary function is to prevent missed deadlines. In its simplest form, this might be a spreadsheet or a basic software application that lists key dates for various tax types like sales, excise, property, and income. It answers the question, “When is it due?”

Tax Compliance Intelligence

In contrast, tax compliance intelligence is designed to gain visibility into the entire compliance lifecycle. It goes beyond due dates to address the “who, what, how, and why” of tax operations. This type of software integrates deadline tracking with workflow automation, task management, document storage, and performance analytics. It serves as a central command center for the entire tax team. It goes beyond tax returns to include audits, assessments, and internal controls.

Core Capabilities: A Head-to-Head Comparison

Let’s break down the functional differences between a standard tax calendar and modern tax compliance intelligence.

| Capability | Tax Calendar | Tax compliance intelligence |

| Due-Date Tracking | Core function; requires manual updates for holidays and weekends. | Automated and dynamic, with pre-built logic for weekends and holidays. |

| Workflow Automation | None. Processes are managed externally via email or chat. | Centralized, configurable workflows that automatically assign tasks and route approvals. No more digging through emails and chats. |

| Approvals | Manual and offline, lacking a clear audit trail. | Digital, role-based approval steps with time-stamped records. |

| Audit Trail | Non-existent or fragmented across different systems. | A complete, centralized, and immutable record of all steps taken. |

| Reporting & Analytics | Limited to a list of past and upcoming deadlines. | Dashboards for team performance, workload distribution, and risk exposure. |

| Risk Controls | Minimal; relies on manual oversight. Spreadsheet lines can be accidentally deleted. | Proactive alerts, role-based security, and visibility into potential bottlenecks. |

| Scalability | Becomes unwieldy as the number of jurisdictions or filings grows. | Designed to scale with your business, easily managing thousands of obligations. |

| Security | Basic, often limited to file-level permissions on a shared drive. | Granular, role-based access controls to protect segregation of duties. |

When a Simple Tax Calendar Works

A basic tax calendar or tax calendar software can be sufficient for organizations with straightforward compliance needs. This approach may be adequate if your business:

- Leaders are comfortable with spreadsheet risk.

- Operates in a few jurisdictions.

- Has very limited tax liability.

- Manages a small number of monthly or quarterly filings.

- Has a small, centralized tax team where communication is simple.

- Faces minimal regulatory complexity.

For a small business with only a handful of tax returns, a well-managed spreadsheet can get the job done. The risk is low, and the process is simple enough for one person to oversee.

When You Need Tax compliance Intelligence

As an organization grows, the limitations of a tax calendar become painfully clear. The risk of error increases exponentially with each new jurisdiction, legal entity, or team member. You need to upgrade to tax compliance intelligence when you see these signals:

- Spreadsheet Overload: Your primary tax calendar is a complex spreadsheet with dozens of tabs that is difficult to maintain and prone to formula errors.

- Lack of Visibility: Leadership has no clear view of the compliance status, and you cannot easily report on team performance or risk.

- Recurring Last-Minute Rushes: Your team consistently scrambles to meet deadlines, leading to burnout and an increased likelihood of mistakes.

- Complex Approval Chains: Getting the necessary sign-offs involves a confusing mix of emails, chats, and manual follow-ups.

- Expansion into New Markets: Your company is adding new legal entities, entering new states, or acquiring other businesses, dramatically increasing your filing obligations.

For example, a motor fuel distributor operating across 40 states must manage hundreds of monthly excise tax filings. Each jurisdiction has unique forms, payment due dates, and form due dates. A basic tax calendar is insufficient to manage the complex workflows necessary for adapting to regulatory changes, identifying risks, and obtaining payment approvals required for compliance.

The ROI of Moving Beyond a Tax Calendar

Upgrading from a tax calendar to tax compliance intelligence is not just an operational improvement; it is a strategic investment in risk mitigation and efficiency.

The costs of sticking with an inadequate system are significant. Fines and penalties for late filings or incorrect payments can quickly accumulate. For example, one company experienced a deadline error in their spreadsheet that cost them $150,000. Beyond direct financial costs, there is reputational damage and increased audit scrutiny that comes with poor compliance.

Another example we’ve heard involves an employee in the tax department responsible for federal gasoline tax refunds who was away on vacation during a key period. In her absence, substitute accountants were unaware of the June 30 filing deadline. When she returned, she proceeded to submit the refund request. However, because it was not submitted both accurately AND within the required timeframe, the claim was denied, resulting in a direct hit to the company’s bottom line exceeding $500,000. Ouch!

On top of penalties and fines, the “hidden cost” of manual processes is team inefficiency. Highly skilled tax professionals spend valuable time on low-value administrative tasks like chasing approvals and digging through emails when internal auditors need proof of payment and filing. Automating these workflows frees them to focus on strategic initiatives, such as tax planning and risk analysis, that deliver greater value to the business.

Implementation: Moving to a New System

Transitioning to tax compliance intelligence requires careful planning but is more straightforward than many believe.

- Change Management: Communicate the benefits of the new system to the entire team. Highlight how it streamlines work and eliminates deadline surprise stress, not just add another tool to their plate. Download the “Change Management for Tax Teams” guide for help with leading change.

- Onboarding and Training: Choose a vendor that provides support, including video training and access to specialists. A phased rollout, starting with one tax type or a single entity, can ease the transition.

How to Evaluate Tax Compliance Intelligence

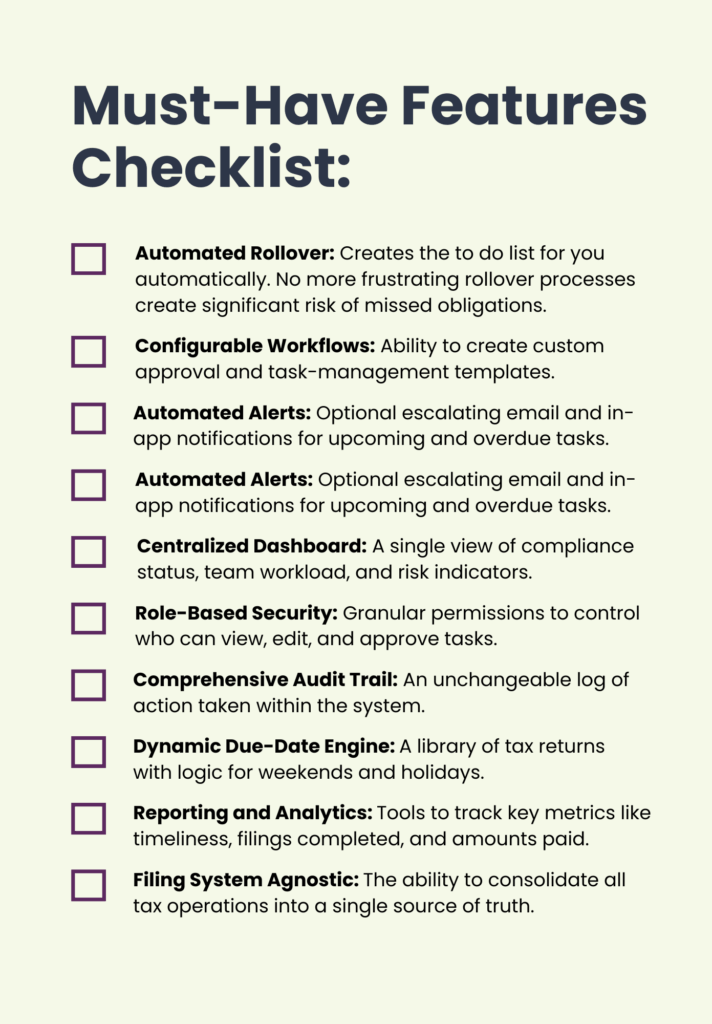

When you are ready to make the switch, use this checklist to evaluate potential vendors. A true tax compliance platform should offer more than a glorified tax calendar.

Step Up Your Compliance Game with ComplyIQ

Are your tax operations still running on spreadsheets and manual reminders? It’s time for a more strategic approach.

ComplyIQ is more than just tax calendar software. It is a comprehensive tax operations command center built to manage due dates, automate workflows, and give you complete visibility into your compliance process. Stop worrying about deadlines and empower your team with a tool that reduces risk, improves efficiency, and scales with your business.

See how ComplyIQ can transform your tax operations!

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing