One Spreadsheet Error. A $150k Penalty. Here’s What Excise Tax Teams Can Learn.

*Based on a true story*

When a tax team was shifting responsibilities due to a long-term employee’s departure, they believed they had everything under control. All deadlines were well documented in a spreadsheet. Relying on this tool, they processed payments in accordance with the due date. What they didn’t realize, however, was that the spreadsheet was backed by tribal knowledge, which wasn’t documented. The payment needed to arrive at the treasury by the due date, not just be submitted.

The result? A costly $150,000 penalty for late payment.

Spreadsheets are great tools for tax professionals; they enable rapid data manipulation and analysis, but they lack the control and visibility for critical tax operations. This introduces significant risks for tax leaders. The real problem here is bigger than one spreadsheet mistake.

The Bigger Problem of Managing Tax Ops in Spreadsheets & Email

Tracking fuel tax deadlines in spreadsheets and approvals in email might feel familiar, but it’s a risky way to manage a critical, high-stakes function. With hundreds of excise tax returns across jurisdictions, tight deadlines, and complex prep and reconciliation, spreadsheets and emails distract from the demands of fuel tax compliance.

Here’s where spreadsheets fall short:

- Excessive dependency on individuals: When individual team members manage spreadsheets with no shared standard, knowledge gaps emerge. And when a key team member walks out the door, so does their unwritten knowledge.

- Lack of visibility in tax operations: When you can’t quickly see your tax operations status, you can’t easily control it. You’re left waiting, hoping nothing critical slips through the cracks. Manual tax calendars, uncontrolled spreadsheets, and buried approvals turn your tax process into a black box. You don’t know where things stand until something goes wrong.

- Risk builds quietly: Tax team members often feel anxious about deadlines, approvals, and filings, uncertain whether tasks were completed on time and correctly, due to unforeseen risks and lack of control in spreadsheets and email. So instead, they force preparation to be completed significantly earlier than necessary, putting more stress on the team and causing burnout. Since they pay early, this also diminishes the time value of money (TVM).

- No reminders or built-in fail-safes: Fuel excise tax deadlines vary on a state and county level and are subject to holiday adjustments. Spreadsheets don’t send alerts, escalate risks, or auto-adjust for weekends and state holidays, making missed deadlines much more likely. This is extra true in the age of the silver tsunami with key personnel retiring and critical processes being transferred with insufficient knowledge transfer.

- Inefficient scaling: As your business expands into more states, more complexity in your distribution model, and more locations, your spreadsheet gets more brittle. Without automation and centralized visibility, it becomes a bottleneck instead of a control system.

Recently, a tax leader half-jokingly said they run on “spreadsheets and a whip,” but the reality is far from funny when a single misstep can lead to costly errors, missed deadlines, and compliance risks. The good news? Better solutions exist.

3 Ways to Modernize Your Tax Operations

Fuel tax compliance doesn’t have to be a manual grind. ComplyIQ, helps fuel businesses gain control, reduce risk, and streamline operations.

Here’s how:

1. Automate Deadline Tracking and Payments

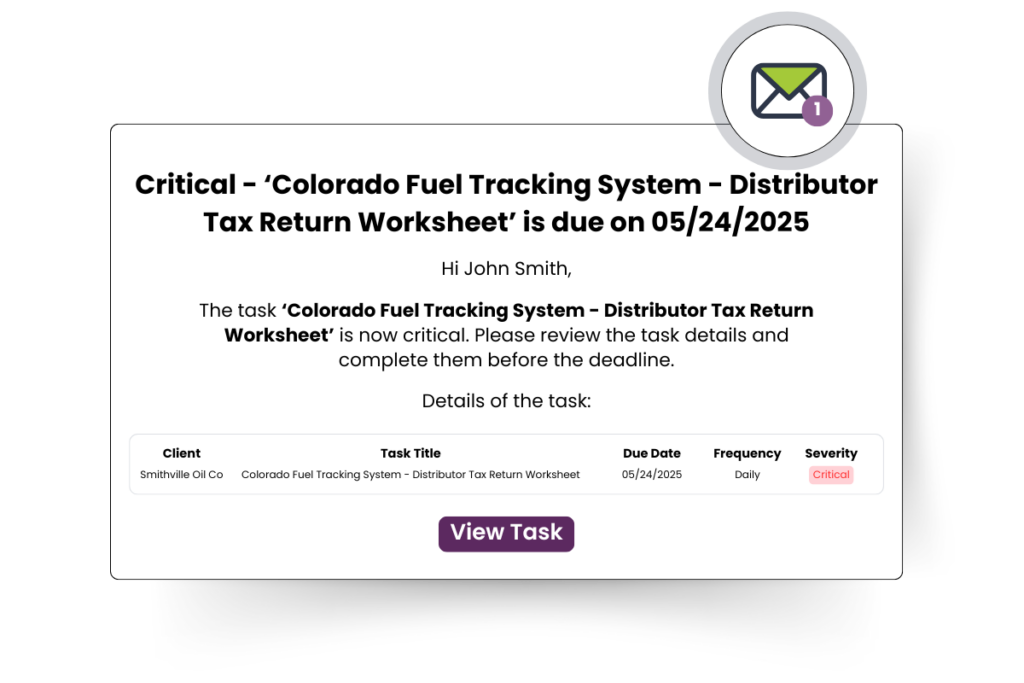

Many teams still rely on manual spreadsheets or buried email chains, systems that are prone to human error. Robust tax operations software, like ComplyIQ, provides automatic deadline tracking and escalated alerts. Notifications ensure no important dates are missed, and due dates adjust automatically for weekends or holidays.

2. Configurable Approval Workflows to Meet Your Control Objectives

Manual handoffs and unclear ownership create risk. With configurable workflows, you can build the oversight and accountability your tax function requires.

Configurable approval workflows:

- Enforce Accountability with role-based visibility and access controls

- Stay informed through real-time email and in-app task notifications

- Reassign tasks temporarily or permanently to adapt to team changes or absences

- Personalize Workflows to match your organizational structure and compliance needs

These not only minimize errors but also ensure continuity if team members leave or go on vacation.

3. Shift from Reactive to Proactive Tax Management

Risk assessment dashboards and key metrics provide full visibility into compliance health and team workload, like:

- Timeliness of completion

- Number of excise tax filings

- Amount paid

No more black boxes in your tax operations. This visibility empowers continuous process improvement and helps tax leaders demonstrate strategic value to executives with complex data, not just gut feel.

Why Choose Tax Due Date Tracking & Approval Workflow Automation?

Moving toward tax automation brings immediate, tangible benefits that reduce risk and free up your team to focus on higher-value work:

- Peace of mind – Say goodbye to sleepless nights worrying about missed deadlines or surprise assessments.

- Scalable processes – Confidently manage growing compliance demands as your business expands into new jurisdictions.

- Reduced risk exposure – Prevent penalties and audit issues with on-time filings and built-in controls.

- Clear accountability – Role-based task ownership eliminates confusion and ensures every step is covered.

- Real-time visibility – See what’s done, what’s pending, and who’s responsible—all in one place.

Managing tax operations with spreadsheets and email is like playing with fire. It’s only a matter of time before something goes wrong, whether it’s a transposed date, a missing cell, or the departure of a key team member.

Modern tax operations software, like ComplyIQ, eliminates the risks and headaches of manual tracking, ensuring your tax operations are smooth, efficient, and foolproof. Don’t wait for a $150k wake-up call, with tools like automated workflows, deadline tracking, and centralized visibility, you can protect your organization from costly mistakes and unlock the full potential of your tax team.

Are spreadsheets keeping you up at night? It’s time to make a change.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing