Overcoming General Ledger Reconciliation Challenges

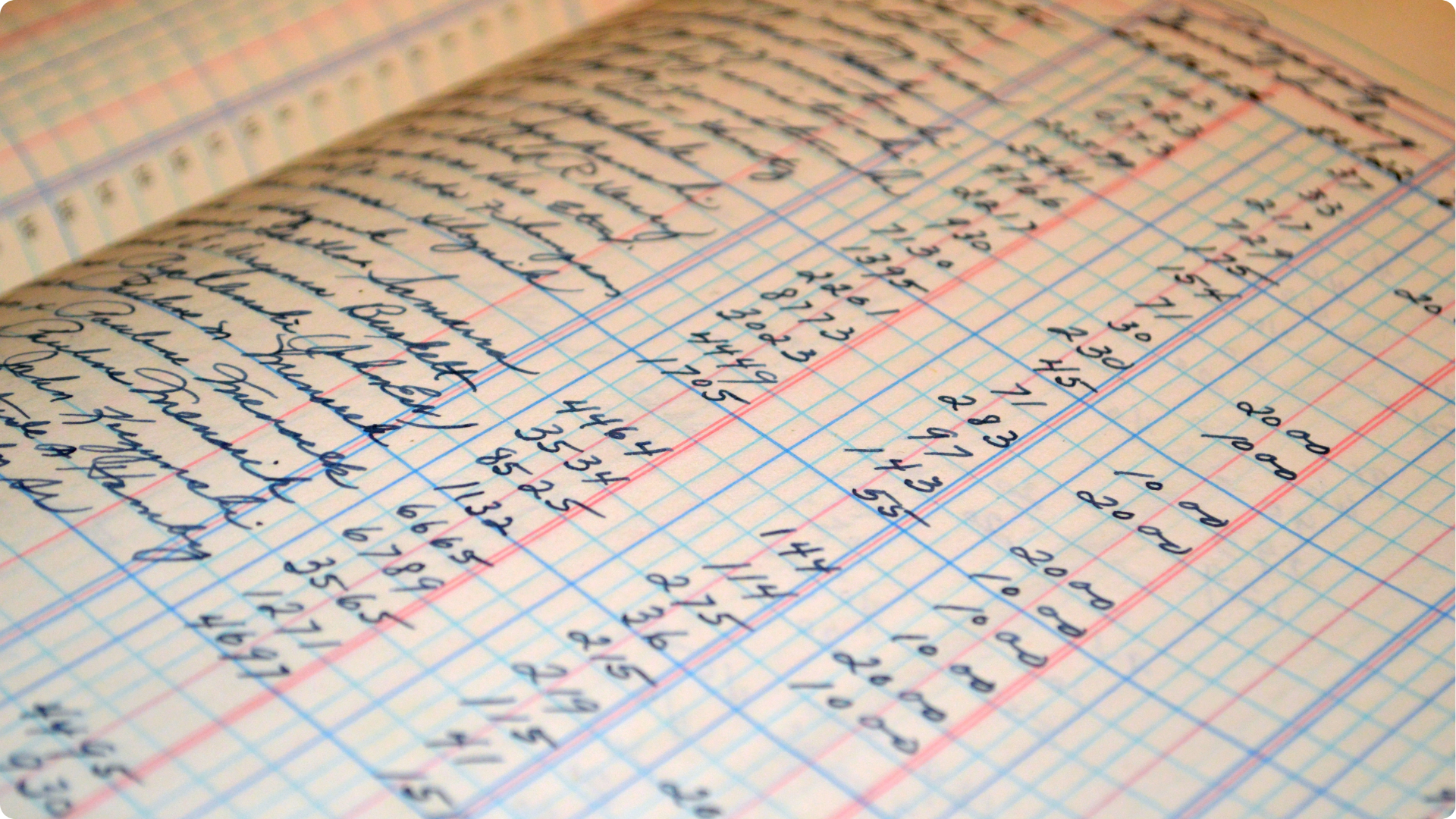

The general ledger is the backbone of the accounting team. It provides a complete record of all financial transactions of a company. This is then referenced to prepare financial statements and reports.

General ledger reconciliation is a critical financial close process that ensures the accuracy and integrity of a company’s financial records. However, it is not without its challenges. From discrepancies and errors to the complexities of large datasets, accounting, finance, and tax professionals can face obstacles during the general ledger reconciliation process. We explore these challenges and provide practical solutions to overcome them.

Manual data maintenance

Challenge

Preparing data can make you feel like you’re on a hamster wheel and can’t get off.

The average tax department spends roughly 80 percent of their time collecting and entering data, and only 20 percent of their time actually using that data.

Team members often find themselves in a tiresome general ledger reconciliation process: extracting data from the GL, importing it into a spreadsheet, fixing elements to the best of their ability, matching data manually, performing VLOOKUPs, identifying discrepancies, and then preparing a formal report, and getting it approved. That is a lot to read, let alone perform every month.

Reconciling and preparing data is not easy and can, unfortunately, become the bulk of a team member’s workload. However, it doesn’t have to.

How to Overcome

You can work to reduce manual data maintenance by:

- Centralizing data management in a single, unified platform or database. Having a centralized repository reduces the need for manual updates across multiple systems and ensures data consistency. For example, changes in one part of the system are reflected throughout, streamlining data maintenance and reducing the need for manual changes.

- Investing in advanced reconciliation software with automation features. These tools can mirror and automate repetitive reconciliation tasks. By leveraging rule-based engines, reconciliation software can streamline processes, allowing finance teams to focus on exceptions and more complex aspects of reconciliation.

Lack of visibility with stakeholders

Challenge

Managing huge amounts of data in the general ledger is a challenge alone. Adding multiple stakeholders to the GL reconciliation process gets even trickier. How often have you searched for a modification you know was supposed to be made but forgot if it was in an email, discussed during a meeting, or conveyed through a Teams chat? Likewise, how often have you pestered a co-worker, asking if their portion of the reconciliation was done so you could start your tasks?

This results in a lack of transparency and accountability, making the business vulnerable to errors. Problems like disjointed spreadsheets or email communications contribute to workflow bottlenecks, adversely affecting the promptness and accuracy of the reconciliation process.

How to Overcome

Increase visibility in the GL recon process by:

- Maintaining comprehensive audit trails. Ongoing audit trails track changes made in the general ledger. This will enhance visibility and accountability while providing historical records for reconciliation activities.

- Streamlining an effective collaboration method for your team instead of sifting through multiple forms of communication to complete reconciliation. This could look like a Teams channel or a Slack group. This communication type can facilitate the sharing of information and updates in real-time.

- Implementing a tool to monitor the progress of reconciliation tasks if your team has multiple hands in the reconciliation cookie jar. This can be achieved through a role-defined task management workflow or a performance dashboard that displays the current status of each task.

Finding a needle in the haystack

Challenge

Rejections, assessments, amendments, and audits are enough to trigger anxiety and dread. It’s usually difficult to find the data that caused the error, especially if you must resort to V-LOOKUPs in multiple spreadsheets and then reference invoices, movement documentation, and notes in another environment. Here are some solutions to streamline the general ledger reconciliation process in a way that doesn’t throw you into a tailspin.

How to Overcome

Find that needle by:

- Utilize exception reports! These reports can play a crucial role in identifying errors in the general ledger by flagging irregularities, outliers, or discrepancies that deviate from established norms. You can set up rules for fuzzy matching and exact matching depending on what you need.

- Automate the generation of exception reports if you have the budget. This allows for swift investigation and resolution of discrepancies during general ledger reconciliation, which frees up time to focus on other strategic initiatives.

Poor data quality

Challenge

The accounting team is plagued by missing data, misspellings, duplicate information, inconsistencies, and wrong formatting.

Have you ever heard of the 1-10-100 rule for data quality? It states that it costs $1 to verify a record, $10 to fix errors, and $100 per year to leave bad data in your system. The cost of poor data adds up quickly, especially for businesses with a large database.

No accounting professional wants poor data quality, but they often must accept it. Your team deserves better.

How to Overcome

Addressing bad data in the general ledger requires a multi-faceted approach to ensure accuracy and reliability.

- Implement data checks. This includes validating data for completeness, accuracy, and consistency.

- Communicate expectations to departments involved in data entry. Expectations and best practices should be clear to everyone involved.

- Offer training programs on data entry best practices to team members in your department and outside of the department, and emphasize the importance of data accuracy. This builds a culture of diligence and precision.

- Invest in advanced reconciliation software incorporating automation to streamline the general ledger reconciliation process. These solutions can help flag potential issues and suggest corrective actions. They can also send automated alerts when discrepancies are identified.

- Establish a well-defined data governance framework that ensures accountability and adherence to data quality standards throughout the organization.

By combining these measures, organizations can mitigate the impact of bad data and enhance the integrity of their general ledger reconciliation processes.

Misplaced talent

Challenge

Let’s state the obvious. Accounting professionals don’t want to spend most of their time manually manipulating and formatting data, like reconciling a general ledger. They would rather be focusing on analyzing data and working on strategic initiatives.

Same with IT. Often, IT is tasked with creating internal solutions to help with data preparation. This comes with time commitments for system maintenance, not to mention all the regulatory changes that come with indirect tax.

How to Overcome

Empower your accounting, finance, IT, and tax teams by:

- Evaluating and streamlining the reconciliation processes to eliminate unnecessary steps and complexities. Simplify workflows where possible to reduce the time required for reconciliation tasks.

- Cross-train team members on various aspects of the general ledger reconciliation process. This ensures that multiple team members can handle different tasks, reducing dependencies and enabling flexibility in resource allocation where necessary.

- Invest in the power of automation. Automating your general ledger reconciliation process can generate reconciliation reports in a fraction of the time. This reduces the time accounting needs to spend reconciling. It also reduces the heavy lifting of creating, updating, and maintaining internal solutions or SQL statements.

By adopting these solutions, accounting teams can optimize their general ledger reconciliation process, freeing valuable time for their team to focus on higher-value tasks and strategic initiatives.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing