Accelerating Digital Tax Transformation in the Age of the Silver Tsunami

The fuel industry faces a significant challenge with the impending “silver tsunami,” as seasoned excise tax professionals approach retirement. This wave of retirements threatens to create a critical knowledge gap in managing federal, state, and local fuel taxes, an area already underserved by formal education and new talent pipelines. Below is an analysis of the challenges, risks, and potential solutions to address this issue.

The Risk of Not Planning Ahead

Without a deliberate succession strategy, excise tax teams face:

- Knowledge gaps that create bottlenecks in tax compliance and audit response.

- Higher operational risk, including misinterpreting motor fuel tax statutes, missed deadlines, license lapses, and costly errors.

- Extended onboarding cycles for new hires, who need months (if not years) of shadowing to get up to speed. A new hire should shadow a professional for at least a year to fully understand the obligations the job requires.

- Loss of strategic insight around exemptions, credits, and discounts.

The cost isn’t just internal disruption; it’s exposure to regulatory penalties, shaky relationships with authorities, and missed opportunities to improve cash flow.

What Effective Succession Planning Looks Like in Excise Tax

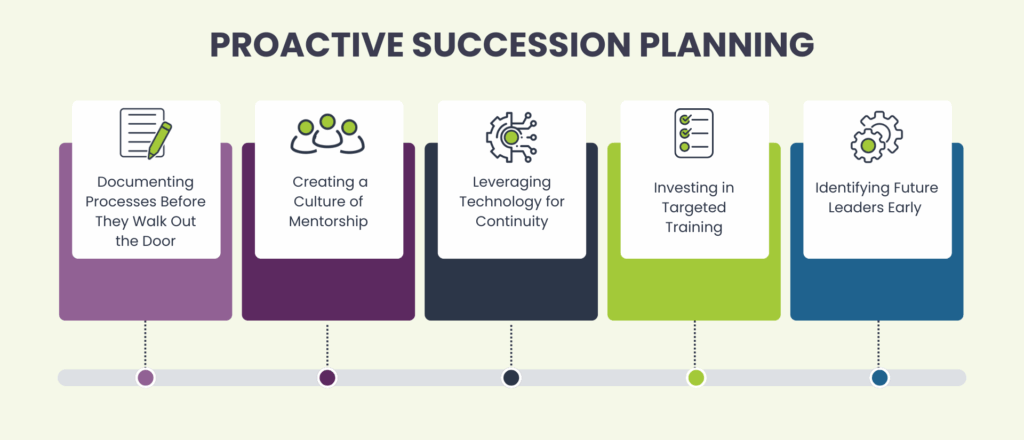

Excise tax leaders can’t afford to leave knowledge transfer to chance. A proactive approach should include:

1. Documenting Processes Before They Walk Out the Door

Too often, expertise lives in spreadsheets, emails, or one person’s head. Standardizing processes, building playbooks, and maintaining an up-to-date compliance calendar can help preserve continuity when roles change.

Pro Tip: Don’t leave filing dates up to interpretation. Either digitize your compliance calendar with tax operations software like the ComplyIQ Compliance Dashboard or maintain crystal-clear documentation of both the filing date and the date the jurisdiction must receive it. We’ve seen the consequences firsthand, a fuel company once paid $150,000 in penalties simply because they assumed the due date was the filing date, not the jurisdiction’s receipt date.

2. Creating a Culture of Mentorship

One of the most effective ways to transfer native knowledge in excise tax is by having senior team members actively involve newer staff in real-world tasks. Whether it’s navigating a multistate audit, reconciling a complicated fuel tax return, or interpreting subtle differences in state regulations, these experiences are where much of the knowledge is passed down.

This approach goes beyond traditional classroom or webinar training:

- Hands-on observation: New team members learn not just the “what” of processes, but the why behind decisions, why certain exemptions are applied, why documentation is handled a certain way, and how to anticipate jurisdictional questions.

- Guided practice: Senior staff can coach through decisions in real time, explaining the rationale for specific filings, risk assessments, or corrections. This creates a safe environment for learning without jeopardizing compliance.

- Storytelling & context: Real-world examples often carry lessons about pitfalls, workarounds, and best practices that never make it into manuals. Sharing these “war stories” builds intuition and judgment.

- Incremental responsibility: By gradually giving newer staff ownership of smaller tasks under supervision, teams cultivate confidence and competence before handing off larger responsibilities.

In essence, sitting in on audits, reconciliations, and strategic decisions allows new hires to absorb institutional knowledge that can take decades to acquire. Encouraging this type of mentorship transforms knowledge transfer from a passive exercise into an active, measurable, and highly impactful part of succession planning.

3. Leveraging Technology for Continuity

Relying on one or two people to “know how it’s done” is one of the most significant vulnerabilities in excise tax. Tax compliance software solutions can reduce that dependency by embedding workflows, filing calendars, regulatory and rate updates, and compliance logic directly into the system, so this knowledge can live in an accessible, standardized platform rather than in individuals’ heads.

The benefits go beyond risk reduction:

- Continuity during turnover – If a key team member retires or leaves, the process doesn’t grind to a halt.

- Faster onboarding – New staff can follow system-driven steps and timelines instead of waiting months to absorb institutional knowledge.

- Built-in compliance checks – Automated validations catch errors early, preventing costly mistakes before they reach jurisdictions.

- Scalability – As filing volumes or jurisdictions increase, technology scales in a way that manual processes and human memory simply cannot.

In short, technology doesn’t just support your team, it future-proofs your tax function against the very real risks of the silver tsunami.

4. Investing in Targeted Training

Because excise tax isn’t taught in college, most professionals learn it through hands-on experience and specialized resources. Industry events like FTA conferences, training programs from associations, and structured internal learning are essential to building that expertise. That’s why ongoing education shouldn’t be optional; it needs to be a dedicated line item in every tax department’s budget.

Pro Tip: Several states provide collection allowances for timely filing and accurately paying your tax obligation. those funds could be used to offset, if not completely cover, the training events and conferences.

5. Identifying Future Leaders Early

Succession planning isn’t just about replacing retirees; it’s about training the next generation of excise tax leaders. Identify high-potential team members now and give them stretch assignments that prepare them to lead.

Why This Moment Matters

Every day in America, 10,000 Baby Boomers hit age 65. That retirement wave isn’t coming; it’s here. For excise tax, succession planning isn’t a future strategy; it’s an urgent necessity. Wait until a key person gives notice, and you’re already too late.

Low headcount in the face of the Silver Tsunami? See how CSX reclaimed 1,888 hours and automated 23 returns.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert