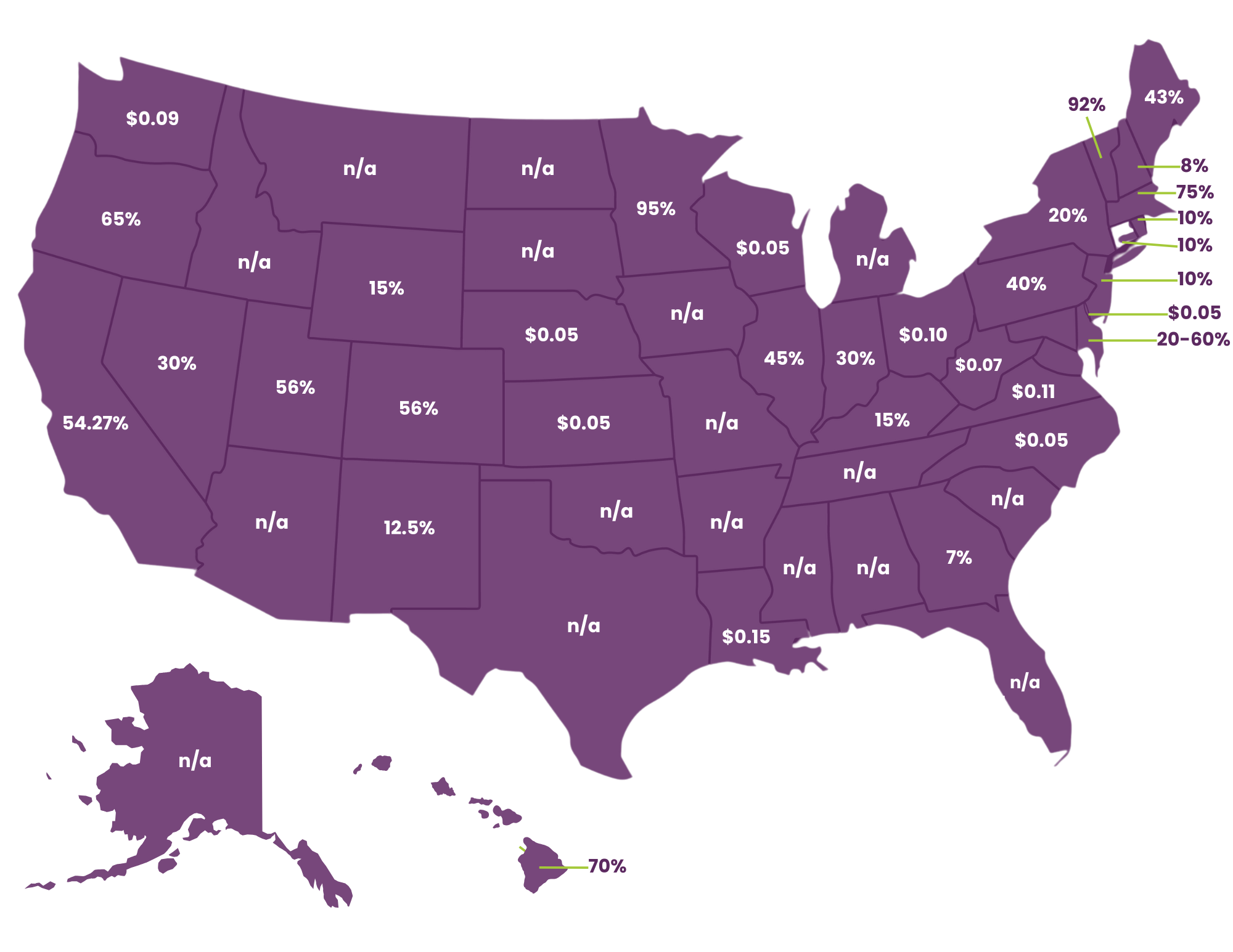

Vape & E-Liquid State Excise Tax for 2025

See the current vape taxes by state. We’ve included the tax rates for each state that levies an excise tax on vaping products. Plus, see which states have the highest and lowest tax rates.

Some states tax open and closed vaping products differently.

- Open: Allows the user to refill the liquid and has more freedom in voltage and nicotine levels.

- Closed: Usually sold as pods or cartridges. Closed systems often have higher nicotine levels to allow for consumption of the desired amount of nicotine in shorter sessions.

We also want to note that these taxes may not just apply to nicotine-based vaping products. Some states levy taxes on e-liquid whether it contains nicotine or not. We’ve provided that information for you too.

Read more on the PACT Act here.

Plus, download our 2025 State Excise Tax Rate Info Table to view vapor product rates and non-nicotine e-liquid taxation status.

Vape and E-Cig Tax by State

| State | Vape Tax/ E-Cig Tax | Is Non-Nicotine E-Liquid Taxable? |

|---|---|---|

| Alabama | no tax | No |

| Alaska | no tax | No |

| Arizona | no tax | No |

| Arkansas | no tax | No |

| California | 54.27%, additional 12.5% of retail | No |

| Colorado | 56% | No |

| Connecticut | 10%, $0.40/ml | No |

| Delaware | $0.05/ml | No |

| District of Columbia | 71% | No |

| Florida | no tax | No |

| Georgia | $0.05/ml, 7% | Yes |

| Hawaii | 70% | Yes |

| Idaho | no tax | No |

| Illinois | 45% | Yes |

| Indiana | 30% VALM closed, 30% of retail on open | Yes |

| Iowa | no tax | No |

| Kansas | $0.05/ml | Yes |

| Kentucky | 15%, $1.50 | Yes |

| Louisiana | $0.15/ml | No |

| Maine | 43% | Yes |

| Maryland | 20% – 60% | Yes |

| Massachusetts | 75% | Yes |

| Michigan | no tax | No |

| Minnesota | 95% | No |

| Mississippi | no tax | No |

| Missouri | no tax | No |

| Montana | no tax | No |

| Nebraska | $0.05/mL, 10% | No |

| Nevada | 30% | Yes |

| New Hampshire | 8%, $0.30/ml | No |

| New Jersey | 10%, $0.10/ml | No |

| New Mexico | 12.5%, $0.50/cartridge | Yes |

| New York | 20% of retail | Yes |

| North Carolina | $0.05/ml | No |

| North Dakota | no tax | No |

| Ohio | $0.10/ml | No |

| Oklahoma | no tax | No |

| Oregon | 65% | Yes |

| Pennsylvania | 40% | Yes |

| Rhode Island | 10%, $0.50/mL | Yes |

| South Carolina | no tax | No |

| South Dakota | no tax | No |

| Tennessee | no tax | No |

| Texas | no tax | No |

| Utah | 56% | Yes |

| Vermont | 92% | Yes |

| Virginia | $0.11/ml | No |

| Washington | $0.09/ml – $0.27/ml | Yes |

| West Virginia | $0.075/ml | Yes |

| Wisconsin | $0.05/ml | Yes |

| Wyoming | 15% | No |

This analysis is intended solely for informational purposes and should not be considered tax advice or used for calculating vape and e-cig taxes.

Federal Vape Taxes

There are currently no federal excise taxes on e-cigarettes. They could be coming soon though. There is already federal legislation affecting sellers of vaping products. Federal vape taxes could be next.

Read up on the latest vaping law here.

What is Vape and E-Cig Tax Revenue Used For?

Revenues collected from vape and e-cigarette taxes are used for a variety of purposes depending on the jurisdiction.

Some states dedicate a portion of tax revenues to smoking cessation programs and health care. For many the revenue ends up in the general fund.

Which State has the Highest Tax Rate?

Comparing tax rates for vaping products is difficult as some states levy a per-unit rate, and others take a percentage of wholesale prices.

That said, the jurisdiction with the highest percentage of wholesale tax rates is Minnesota at 95%.

Kentucky has one of the highest per-unit taxes at $1.50/closed system cartridge.

Which State has the Lowest Tax Rate?

Several states do not have excise taxes on vaping products. However, out of the states that do tax vaping products, one of the lowest is percentage-based taxes in New Hampshire, at 8% of the wholesale price for open vaping products.

Delaware, Kansas, North Carolina, and Wisconsin are also some of the lowest at $0.05/ml.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Jeanne Thompson

Tobacco Tax Subject Matter Expert