3 Powerful Ways Tax Workflow Automation Transforms Tax Operations

Keeping critical tax data, such as due dates, in spreadsheets and relying on manual tax workflows increases the risk of errors and consumes valuable time on low-value tasks. With 45% of employees facing heavier workloads and 13% of tax leaders highlighting talent retention as a significant challenge, manual operations aren’t sustainable.

As regulations grow more complex and deadlines tighten, the pressure is only intensifying. It’s no wonder EY found that 87% of tax professionals expect technology to drive efficiency and effectiveness in tax functions within the next three years, a significant leap from just 15% in 2023.

Tax workflow automation addresses these challenges by streamlining operations, reducing errors, and enabling professionals to focus on strategic priorities. It transforms tax functions, paving the way for a more purpose-filled and efficient future.

What is tax workflow automation?

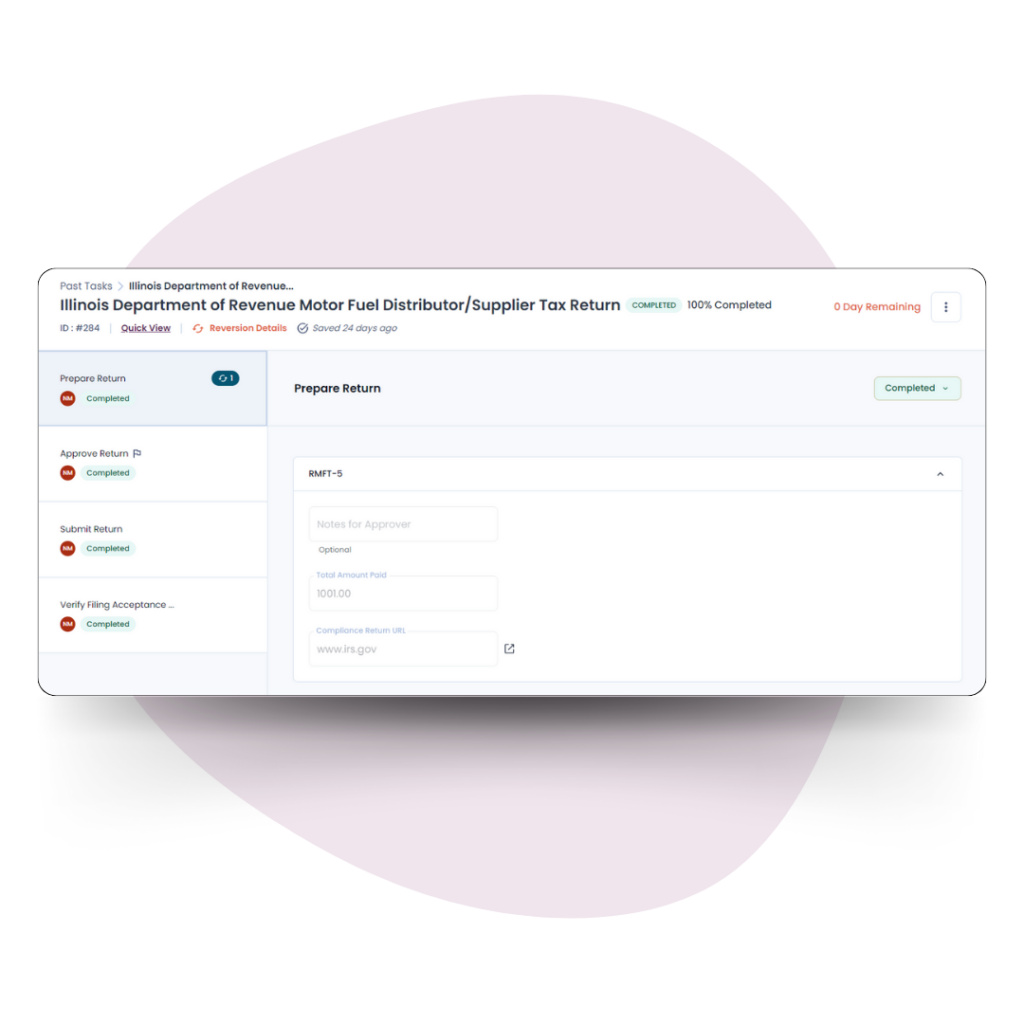

Tax workflow automation uses technology to simplify and streamline tax processes, reducing manual effort and the risk of errors. By automating tasks like compliance tracking, businesses can improve accuracy, enhance transparency, and stay ahead of deadlines. This allows tax teams to focus more on strategy rather than routine administrative work.

3 ways workflow automation revolutionizes tax operations

1. Mitigate Deadline-Related Risks

Meeting tax deadlines is non-negotiable. Relying on manual processes to meet deadlines can leave tax teams vulnerable to errors. Missed filings, late payments, and forgotten due dates can result in penalties, interest, and increased audits, putting the organization at risk.

How Automation Helps:

- Track Deadlines: Automated systems track compliance activities and trigger escalating email alerts and in-app reminders based on risk tolerance levels, keeping your team proactive and on top of every deadline.

- Eliminate Schedule Errors: Automation dynamically adjusts deadlines to account for holidays and weekends, reducing the chance of misaligned schedules and ensuring stress-free tax calendar management.

- Gain Transparency and Control: With role-based dashboards, you gain complete visibility into upcoming filings, payment statuses, and compliance workloads, making it easier to monitor deadline progress and allocate tasks efficiently.

Imagine This:

Managing multiple deadlines can be overwhelming, especially when you’re unsure if everything is on track. Have you ever found yourself worrying late at night about an unsubmitted tax return or missed approval?

Now imagine this instead: a tax workflow automation system takes care of it all. Deadlines are flagged well in advance, holiday adjustments happen automatically, and every team member gets real-time updates on their tasks. No guesswork, no missed schedules—just smooth, stress-free operations.

2. Achieve Consistency Across Tax Operations

Fragmented manual workflows often lead to discrepancies, inefficiencies, and errors that disrupt tax processes. Tax workflow automation is key to establishing consistency by standardizing task management and creating smooth transitions at every stage. Automation ensures tasks are assigned, reviewed, and completed with precision, eliminating bottlenecks and guaranteeing a uniform, reliable approach to tax operations.

How Automation Helps:

- Standardized Approval Processes: Tax workflow automation offers pre-configured approval templates that align with your organization’s needs. These templates reduce variability and ensure a consistent workflow structure, helping your team achieve faster results without manual adjustments.

- Reliability in Recurring Tasks: Automated systems handle the rollover of monthly or annual tasks seamlessly, ensuring consistency without the hassle of manually recreating tasks. This consistency frees your team to focus on high-value work without worrying about deviations.

- Seamless Team Coordination: Tax workflow automation supports smooth collaboration and continuous task progression. Even when key team members are unavailable, workflows adapt to keep processes consistent and uninterrupted.

Imagine This:

Tax teams may face delays due to missed handoffs or unavailable colleagues. Without centralized coordination, tasks can easily slip through the cracks, increasing compliance risks.

Now imagine using workflow automation. Each team member has assigned responsibilities, with the system guiding approvals and sending clear, automated notifications. If someone is unavailable, tasks can then be escalated and re-assigned by the manager—keeping everything on track without delays.

3. Drive Strategic Decision-Making with Data Insights

Automation goes beyond simplifying tasks—it empowers tax teams with actionable insights to drive smarter decision-making.

With 86% of tax leaders prioritizing becoming a more strategic business partner to their CEOs, access to data-driven insights is essential.

Tax leaders gain unprecedented visibility into their operations through real-time dashboards and advanced analytics. This enhanced perspective allows them to proactively identify risks, optimize workflows, and improve overall efficiency, ensuring their role evolves from operational support to strategic leadership.

How Automation Helps:

- Enhance Compliance Oversight: Real-time dashboards provide up-to-the-minute tracking of compliance statuses, filing volumes, and workload distribution, giving you a clear picture and greater control over processes.

- Stay Ahead of Potential Risks: Keep your operations running smoothly with escalating alerts delivered straight to your inbox. Tailored to your risk tolerance, these alerts help your team address near-term deadlines proactively and tackle potential issues before they escalate.

Imagine This:

Tax leaders can now present data-driven insights to stakeholders, demonstrating the value of their tax operations and proactively mitigating risks to the business.

Why automation is non-negotiable for tax teams

Traditional manual processes may have worked in the past, but they simply can’t keep up in a world where there is tax team attribution with compliance landscapes evolve rapidly. Tax workflow automation is no longer just a convenience, it’s a necessity.

Here’s why:

- Time-Sensitive Deadlines: Tax operations often involve tight deadlines. Workflow automation eliminates delays by streamlining approvals, notifications, and task handoffs, keeping everything on track.

- Error Mitigation: Manual tasks leave room for mistakes that can lead to audit risks and penalties. Automated workflows reduce human error by standardizing processes and document management.

- Resource Optimization: Tax teams can stop feeling overworked and under-resourced by automating repetitive, time-consuming tasks, so they can redirect their efforts toward strategic initiatives that add value to the organization.

- Transparency and Accountability: Automation provides clear audit trails and centralized data, allowing tax teams to maintain visibility and accountability across operations.

- Seamless Collaboration: Built-in communication tools ensure smooth task coordination, even with remote teams or during staff absences.

- Scalability: Whether dealing with an increase in volume or expanding the scope of operations, automated workflows grow with your organization, ensuring consistent efficiency.

Don’t let outdated processes hold your tax team back.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing