Turnover on Your Tax Team Is a Sign of Bigger Issues

Is your tax team struggling to handle increasing workloads while facing high turnover? You’re not alone. The tax industry is grappling with a growing shortage of qualified talent, making it harder than ever to retain experienced professionals.

Some of these challenges were predictable, as retirements among seasoned tax leaders loom large. Recent data highlights this shift:

- In 2023, nearly half (47%) of tax leaders were aged 58 or older.

- 39% of tax professionals in secondary positions are also baby boomers.

- Two-thirds of all baby boomer tax leaders are set to retire within the next four years.

But there’s more to the problem than demographics. High turnover, combined with a “do more with less” mindset, is stretching tax teams thin. This shortage isn’t just about finding talent; it’s about retaining the expertise your organization needs to thrive.

The Hidden Costs of Tax Team Turnover

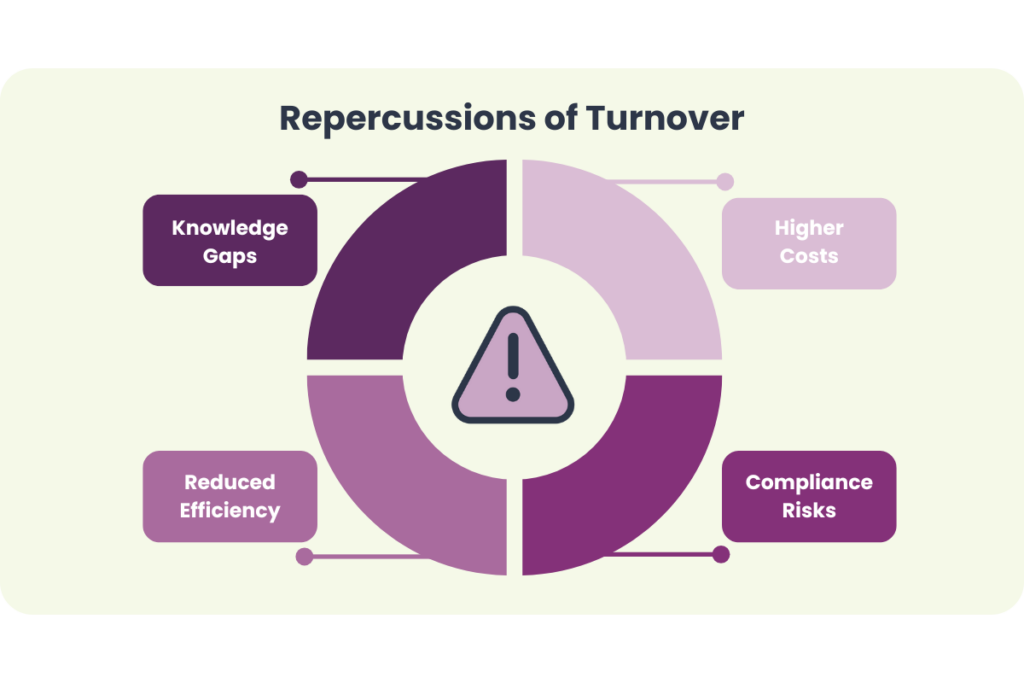

Turnover in your tax department has implications beyond the inconvenience of a vacant desk. Its ripple effects can lead to:

- Knowledge Gaps: Institutional knowledge about complex tax regulations can vanish when experienced professionals leave. This loss takes significant time and resources to recover.

- Reduced Efficiency: New hires require onboarding and time to adapt and learn. After all, specialized tax isn’t taught as a major in college like other disciplines. The time and resources spent on training can divert attention from critical projects, putting additional strain on experienced team members.

- Compliance Risks: A shrinking workforce heightens the risk of reporting errors or missed deadlines, paving the way for costly penalties, increased audits, and potential harm to your company’s reputation and credibility.

- Higher Costs: Recruiting, hiring, and training replacements eat into budgets, not to mention the price of temporary staffing or consultants in the interim.

If your tax team is experiencing frequent turnover, this isn’t just HR’s problem, it could be a symptom of something bigger.

The Bigger Issues Behind Tax Turnover and How to Resolve Them

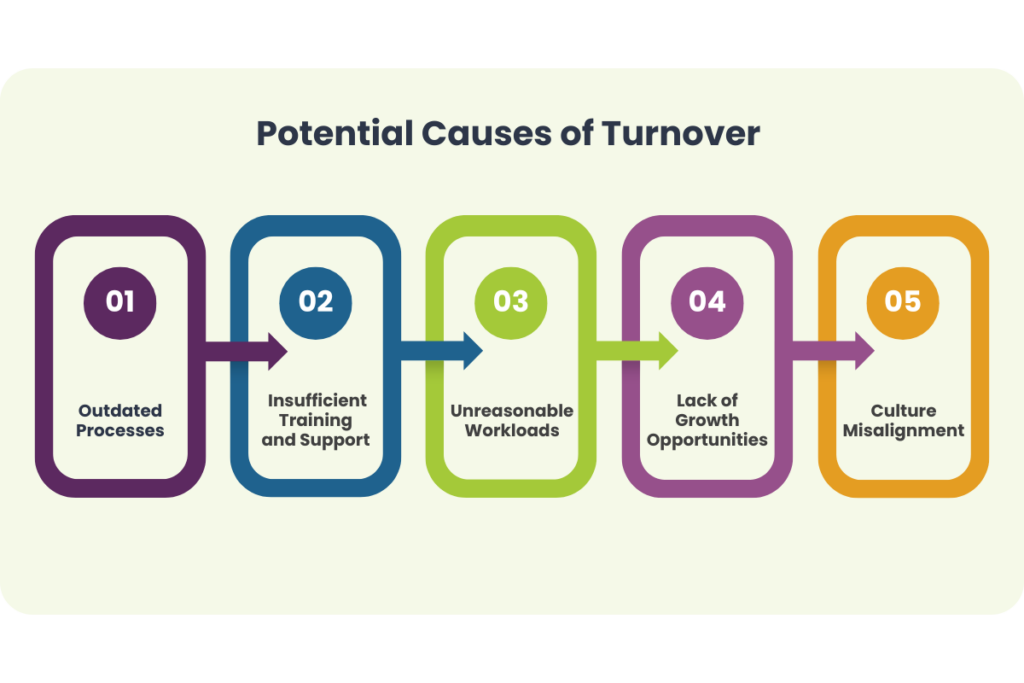

While it’s tempting to attribute turnover to factors like market trends or employee preferences, as a tax leader, it’s critical to look deeper. Below, we’ll explore the potential causes of turnover on tax teams and provide practical steps to address the underlying challenges.

1. Outdated Processes

Does your tax team spend more time on manual tasks than strategic decision-making? Inefficient systems drive dissatisfaction and burnout, a key factor cited by nearly 40% of employees across industries in 2023. Manual, outdated workflows lead to frustration and prevent tax professionals from focusing on high-value work, such as:

- Shaping business strategy.

- Identifying tax allowances, credits, and discounts.

- Providing leadership with actionable insights.

Without modern tools and automation, employees are more likely to feel frustrated and disengaged.

Resolution: Invest in Technology

Automating repetitive tasks with tools like tax compliance software can reduce workloads and improve accuracy. This shift lets your team focus on valuable strategic activities, decrease employee burnout, and increase accuracy and employee satisfaction.

Want a head start? Check out our e-book on “Digital Acceleration in Tax Compliance” for actionable insights. Teams who have digitally transformed their tax process have increased their filing efficiencies by up to 80%!

2. Insufficient Training and Support

While it’s easy to view training programs as an additional expense, the reality is that the cost of turnover, recruiting, and onboarding far outweighs it in the long run. Without access to continuous training and resources to sharpen their skills, team members may feel unprepared, unsupported, and more inclined to search for opportunities that meet their professional growth needs elsewhere.

In fact, according to CFO, 74% of employees place greater value on learning and development than on promotions or title changes.

This should send a clear message to leaders that prioritizing professional development is not only logical, but also integral to keeping your best talent engaged and motivated. Ongoing investment in training not only strengthens expertise and boosts morale but also demonstrates a commitment to your team’s growth. This commitment fosters loyalty, reduces turnover, and ultimately drives long-term success for your organization.

Resolution: Provide Ongoing Learning Opportunities

Start by investing in your employees.

- Provide access to specialized training sessions.

- Encourage them to get new certifications.

- Provide opportunities to network and learn at industry events.

Showing you’re invested in employee growth fosters loyalty and builds expertise within your team.

3. Unreasonable Workloads

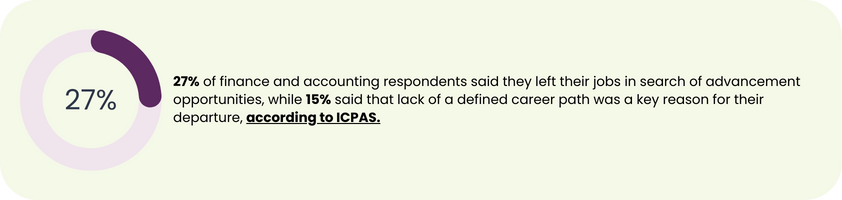

Working on a tax team is commonly associated with long hours and poor work-life balance. According to ICPA, the top reasons respondents gave for leaving their accounting-based jobs within the past two years were:

- Burnout/heavy workload (49%)

- Lack of work-life balance (48%)

Unfortunately, when turnover occurs, this pain point is intensified across all levels of tax.

- 65% of employers said turnover placed a higher burden on staff at similar levels as the employees who left.

- 67% said it increased workloads for staff at leadership levels, according to ICPAS.

Tax teams often face intense pressure during monthly filing periods, but if heavy workloads become the norm all month long, employees may start looking for roles that promise better work-life balance. Teams stretched thin are more susceptible to mistakes and penalties, worsening workplace stress.

Resolution: Optimize Resource Allocation

Take a hard look at workloads. Are you trying to do too much with too little?

- Consider outsourcing low-priority tasks or using automation.

- Track employee hours and tasks to identify when and where resources are stretched too thin.

- Set realistic expectations.

- Check in with team members weekly and provide adequate support.

Consider using tools like automated tax operations workflows to monitor team performance and workloads.

4. Lack of Growth Opportunities

Tax professionals want to feel their roles are more than routine compliance work, and that they aren’t on a hamster wheel until retirement. If career pathways and development opportunities are unclear, employees may leave for organizations with more opportunities.

Resolution: See a Future Within the Organization

- Establish clear pathways for career advancement within your tax department, including opportunities for leadership roles.

- Be diligent about doing annual development plans and regular performance reviews.

Clear communication helps retain top talent. With clear goals, employees are less likely to look for other opportunities.

5. Culture Misalignment

Corporate culture plays a pivotal role in employee satisfaction and retention, often more than leaders anticipate. Yet, for many tax team members, the harsh reality is feeling undervalued and excluded from decision-making processes. Tax professionals want their strategic input recognized, along with a work environment that engages and motivates them. When their efforts go unnoticed, or the team operates in isolation with little collaboration, turnover becomes a significant risk.

Resolution: Foster a Positive Team Culture

A strong and inclusive culture can be the difference between retaining top talent and losing it.

- Start by celebrating your team’s wins, both big and small, to show appreciation for their contributions.

- Provide regular, constructive feedback to help them grow and feel supported.

- Advocate for your tax team to have a voice and ensure they’re part of collaborative initiatives within the organization.

Is your tax department feeling disconnected? Read our guide, “Breaking Down Organizational Silos,” to learn actionable strategies for fostering alignment and collaboration across teams.

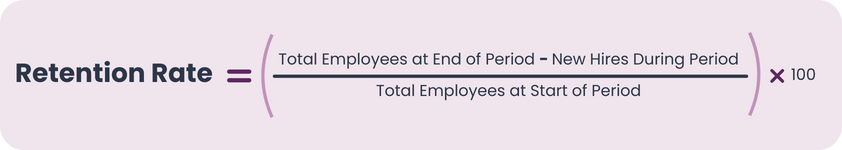

Metrics for Success

Measuring the success of your efforts to reduce turnover starts with tracking the right metrics.

- Employee Retention Rate: Measures the percentage of employees who stay with your company over a given period

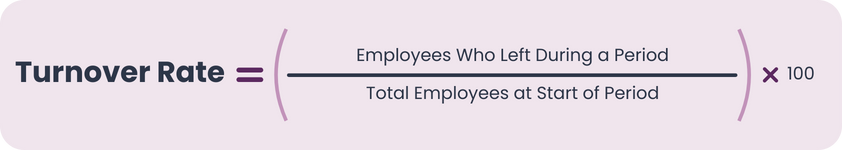

- Employee Turnover Rate: Tracks how often employees leave, either voluntarily or involuntarily.

- Voluntary vs. Involuntary Turnover: Helps identify whether employees are leaving due to dissatisfaction or company restructuring.

- New Hire Retention Rate: Tracks how many new employees stay past critical milestones (e.g., 90 days, 1 year).

- Employee Engagement & Satisfaction Scores: Surveys like eNPS, pulse surveys, performance reviews all keep a pulse on employee satisfaction.

- ROI on Technology: Measure the impact of new tools by tracking improvements in task completion times and error rates. Compare these efficiency gains to retention trends—does faster, more accurate work contribute to employee satisfaction and longevity? For example, if automation software reduces filing times by 50%, the clear ROI may align with higher retention rates

By setting clear, measurable goals and tracking key metrics, you can refine your strategies to drive both efficiency and retention. Identifying trends and correlations—such as how process improvements impact employee satisfaction—enables proactive decision-making. This data-driven approach not only strengthens your tax department’s effectiveness but also fosters a more engaged and committed team.

The Payoff of a Stable Tax Team

Building a stable, engaged tax team doesn’t just mitigate turnover risks. It enhances organizational efficiency, reduces costs, and ensures compliance. Tax leaders play a crucial role in creating these outcomes. By investing in your team’s tools, training, and well-being, you enable them not just to stay—but to thrive.

Don’t wait for turnover to become a crisis.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing