Understanding the TP-1 Tobacco Products Tax Return and Transaction Schedule Change

The Illinois Department of Revenue (IDOR) has introduced critical updates to its tobacco tax reporting process under the Tobacco Uniformity Project. These changes align with the Federation of Tax Administrators’ (FTA) goal of standardizing electronic tax filings across jurisdictions. If your business handles Other Tobacco Products (OTP) tax filings, here’s what you need to know.

What Has Changed?

The updates primarily impact Form TP-1 (Tobacco Products Tax Return) and its associated TP-1 schedules. The most significant changes include:

1. Mandatory Electronic Filing

- New XML-based filing format replaces text and Excel-based submissions.

- Filings must be submitted through a web services-based gateway.

- CSV import files over 50 MB require direct file submission.

2. New Filing Process & Software Requirements

MyTax Illinois users must now comply with the new electronic format.

Taxpayers can use approved software vendors , like IGEN, or develop their own XML-based programs and register as transmitters.

Who Is Impacted?

The new requirements apply to:

- Licensed distributors, service groups, and brokers handling OTP tax filings.

- Electronic filing partners & software developers responsible for tax return submissions.

- MyTax Illinois filers, who must now adhere to XML-based submissions.

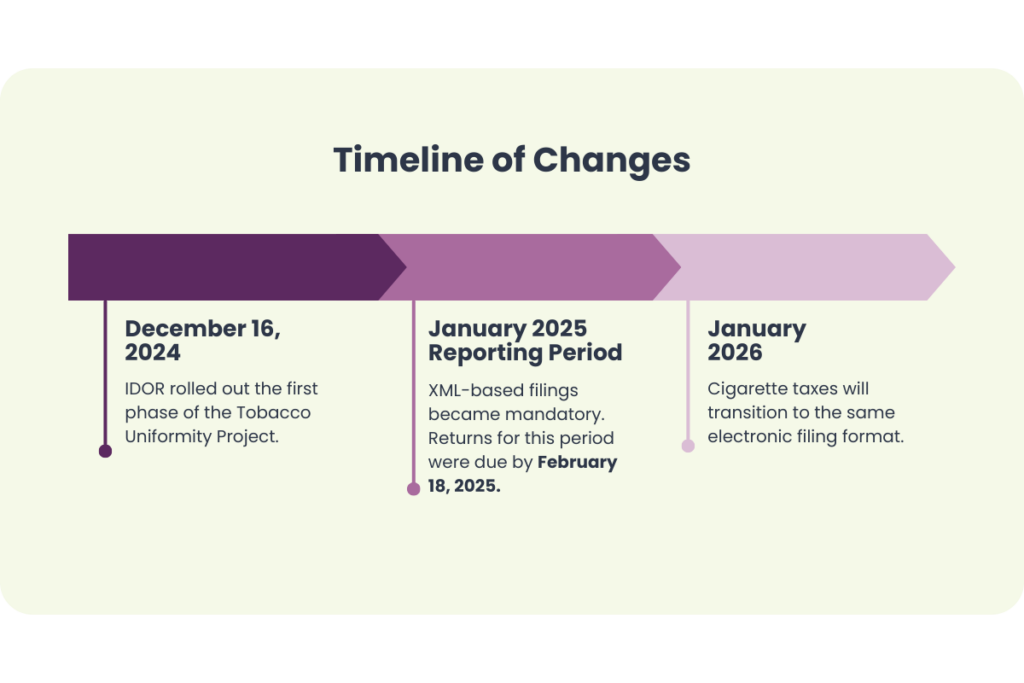

Timeline of Changes

- December 16, 2024: IDOR rolled out the first phase of the Tobacco Uniformity Project.

- January 2025 Reporting Period: XML-based filings became mandatory. Returns for this period were due by February 18, 2025.

- January 2026: Cigarette taxes will transition to the same electronic filing format.

How to Stay Compliant

1. Use Approved Vendors

- IGEN and other IDOR-approved vendors provide compliant XML filing solutions.

2. Prepare Your Data

- Ensure data is correctly formatted in XML before submission.

- Transition from older formats (text/Excel) early to avoid last-minute issues.

3. Leverage IDOR Resources

- Visit the Illinois Department of Revenue Tobacco Uniformity Project page for guidance and FAQs

Why This Matters for Your Team

Switching to XML-based filings requires an initial adjustment but offers long-term benefits:

- Scalability: Once compliant in Illinois, the same system can streamline filings in Wisconsin, Iowa, and Indiana.

- Efficiency: Standardized reporting simplifies multi-state compliance.

- Compliance: Avoid penalties and rejected filings by adopting the new format.

What’s Next?

- Future Phases: Illinois Cigarette taxes move to XML-based filing by January 2026.

- Expansion to Other States: KS, MN, and PA will adopt similar reporting requirements. More states may adopt similar uniform filing standards.

The Tobacco Uniformity Project is reshaping tax reporting. Proactively transitioning to XML-based filing ensures compliance, efficiency, and scalability.

For businesses seeking a seamless transition, approved vendors like IGEN can help implement solutions tailored to IDOR’s new standards.

Start E-filing your TP-1 Return.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here

Chris Roy

Excise Tax Subject Matter Expert