Is your tax process a black box? 5 Practices for Proactive Tax Oversight

You trust your team. You trust the process. You trust that every filing is submitted, every deadline met, every risk managed.

But is that confidence informed by data, or are you merely operating without consequence?

In complex multi-jurisdictional tax environments, such as excise tax, a lack of visibility poses a risk that no tax leader can afford. Many leaders lack visibility of the gap between “task assigned” and “return filed.” You see the results when something goes wrong, but the day-to-day execution remains a black box.

That gap in visibility isn’t just a workflow nuisance. It’s a control risk that undermines your department’s reliability, reputation, and strategic value.

The High Cost of Low Visibility

When you can’t see the true status of your tax compliance lifecycle, you’re leading reactively, and that costs more than late fees.

- Compressed Filing Deadlines: When teams cannot see progress or anticipate bottlenecks, work piles up at the end. This strips critical days from the review and submission process, forcing last-minute scrambles and chaotic, cascading handoffs. The risk of errors multiplies as individuals rush to complete tasks under pressure.

- Early Payments Erode Time Value of Capital: Low visibility into accounts payable workflows forces teams to operate defensively. Uncertain approval timelines, unclear payment statuses, and overly conservative buffers built into the process often lead to payments being issued well in advance of their due dates. This strategy, while intended to mitigate the risk of late fees, directly erodes the time value of money for the organization. Holding onto cash until the last responsible moment is a fundamental component of working capital management.

- Team Burnout and Inefficiency: Your best people may be silently struggling. Without visibility into workloads, you cannot effectively balance assignments. High performers become overloaded while potential issues go unnoticed until it’s too late. This leads to burnout, decreased morale, and higher employee turnover.

5 Best Practices for Proactive Tax Oversight

Shifting from a reactive to a proactive oversight model means more than tightening deadlines or tracking filings. It’s about seeing everything that matters, in real time. Tax leaders need instant insight into team performance, task status, risk exposure, and control health. Here are seven ways to create that level of visibility and confidence.

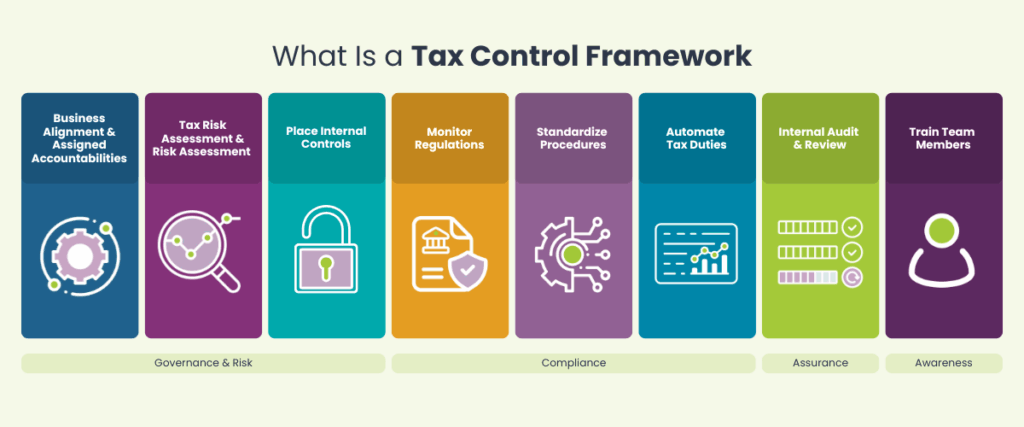

1. Standardize Your Workflows with a Tax Control Framework

A Tax Control Framework formalizes your tax processes through documented policies, controls, and monitoring routines. By establishing a TCF, you bring structure to compliance activities, ensuring they are executed consistently, meet regulatory standards, and provide clear audit trails. But its greatest value for leaders is visibility.

A well-integrated TCF connects directly to your compliance processes and systems, showing you:

- Which controls are active or failing

- Who owns each control and filing step

- Where delays or exceptions are occurring

Integrated into platforms like ComplyIQ, a TCF becomes your window into operational performance and control effectiveness—without relying on manual check-ins.

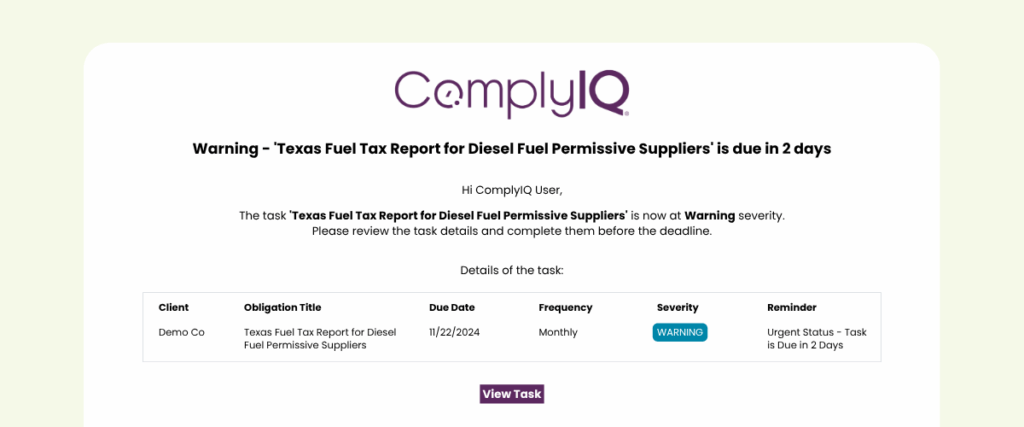

2. Implement Deadline Risk Tiers

Visibility isn’t just about knowing due dates—it’s about understanding risk by priority. Categorizing filings as High, Medium, or Low risk gives leaders a clear visual hierarchy of what requires immediate oversight.

This allows you to:

- Instantly see where exposures are highest

- Reallocate team focus when bottlenecks emerge

- Escalate high-liability filings before deadlines slip

Tax Deadline Risk Tier Framework

| Risk Tier | Typical Reports & Tasks | Key Risk Drivers |

|---|---|---|

| High Risk Tier | – Obligations with high-dollar exposure (e.g., seven-figure remittances) – Time-sensitive assessments requiring rapid response – Filings where a miss triggers immediate cash impact | – Large financial impact – High audit likelihood – Historical filing errors |

| Medium Risk Tier | – Recurring obligations with mid-range dollar exposure – Deadlines that affect cash flow but allow limited remediation – Items dependent on moderately complex or external data | – Moderate exposure – Regular recurring tasks – Occasional dependency on external data |

| Low Risk Tier | – Low-dollar, low-frequency obligations – Administrative filings with limited cash impact | – Minimal financial exposure – Stable and repeatable process – Low audit visibility |

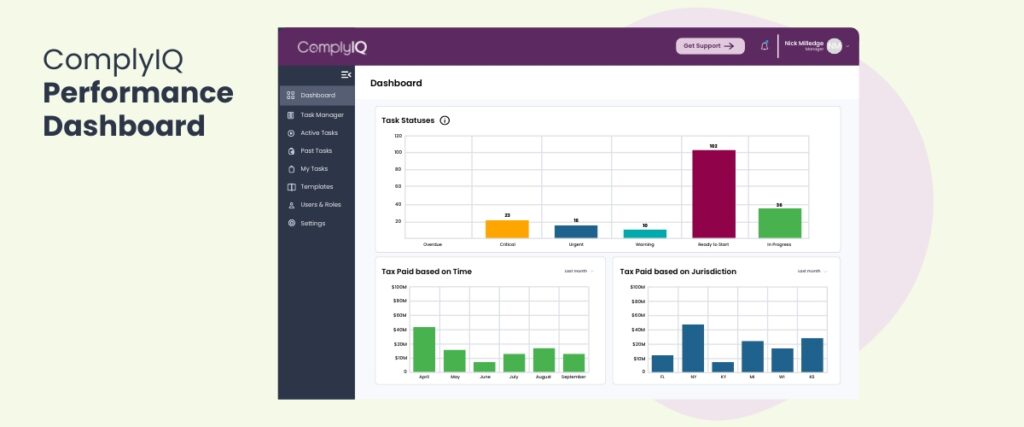

3. Build a Real-Time Oversight Dashboard

Tax leaders need the ability to see the pulse of tax operations instantly. A centralized dashboard, powered by automation, should display:

- Real-time filing progress across all jurisdictions

- Ownership by preparer, reviewer, and approver

- Alerts when a risk threshold is crossed, such as an unapproved return or a missed sign-off.

- Status summaries by entity, location, or product line

This turns oversight into an ongoing process, not an after-action review.

4. Track Team and Process Performance Metrics

Visibility isn’t only operational, it’s analytical. With automated metrics, leaders can spot patterns that signal process risk:

- Average time per filing

- Review-to-submission cycle time

- Task load balance across staff

This gives you the insight to coach your team proactively, rebalance workloads, and demonstrate performance improvement to executives

5. Maintain Audit-Ready Documentation

Every action your team takes—approving, updating, or submitting—should be logged in real-time. For leaders, this isn’t about surveillance; it’s about traceability and defense. Live audit trails show:

- Who performed what task and when

- How issues were resolved

- Whether filings were reviewed, corrected, or resubmitted

When leadership or auditors ask, “What happened here?” you have the full picture, not a reconstruction.

Your Command Center: ComplyIQ

Implementing these practices with disconnected spreadsheets and email chains is nearly impossible. The linchpin of a modern, visible tax operation is a centralized tax operations software. ComplyIQ moves you beyond a simple tax calendar and into a dynamic command center for all compliance activities.

Tax compliance software, like ComplyIQ, provides the functional backbone for proactive oversight:

- Real-Time Work Logs that track every filing and owner

- Automated Alerts & Escalations for faster issue resolution

- Role-Based Dashboards tailored for leaders, reviewers, and preparers

- Performance Analytics that show workload, timeliness, and accuracy trends

Gain the Clarity You Need to Lead

Trusting your team is essential. But verifying progress through data is leadership. The era of managing by assumption is over. Visibility is now a strategic advantage.

With the right technology, you can see every filing, control, and risk in motion, so you’re never blindsided again.

Move from assumption to certainty. ComplyIQ can provide the visibility your tax department needs.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Nick Milledge

VP, Product Marketing