How to Avoid Costly Fuel Tax Credits and Rebills

In the complex world of fuel excise tax, operational errors can lead to significant administrative burdens and financial discrepancies. One of these reporting pitfalls is credits and rebills. While they serve as a corrective mechanism, they often signal underlying problems in data management and operational procedures.

In a recent IGEN and Weaver webinar on “Avoiding Costly Mistakes in Fuel Tax Reporting,” 57% of the attendees said their team filed over 11 amendments last year. Some main reasons for the amendments were bad and missing data, wrong customers, and missed diversions, and state requests.

For tax leaders, minimizing these errors is key to improving efficiency, ensuring compliance, and protecting your team’s time.

What Are Fuel Tax Credits and Rebills?

A credit and rebill is a two-part accounting process used to correct an incorrect invoice related to a fuel transaction. When an error is identified after an invoice has been issued and tax has been reported, the original transaction must be nullified and then re-issued correctly.

Fuel Tax Credit

The first step is to issue a credit memo to cancel the original, incorrect invoice. This reverses the sale in the accounting system, essentially stating that the transaction as initially recorded did not happen. For tax purposes, this means retracting the tax that was reported as paid or collected on that sale.

Fuel Tax Rebill

The second step is to create a new, correct invoice for the transaction. This “rebill” reflects the accurate details, such as the correct purchaser, product, jurisdiction, or tax-exempt status. The tax is then recalculated and reported based on this new information.

This process becomes particularly complicated in fuel tax because it can trigger the need for amended tax returns, which are time-consuming and can draw scrutiny from tax authorities.

An Example of a Fuel Tax Credit and Rebill Scenario

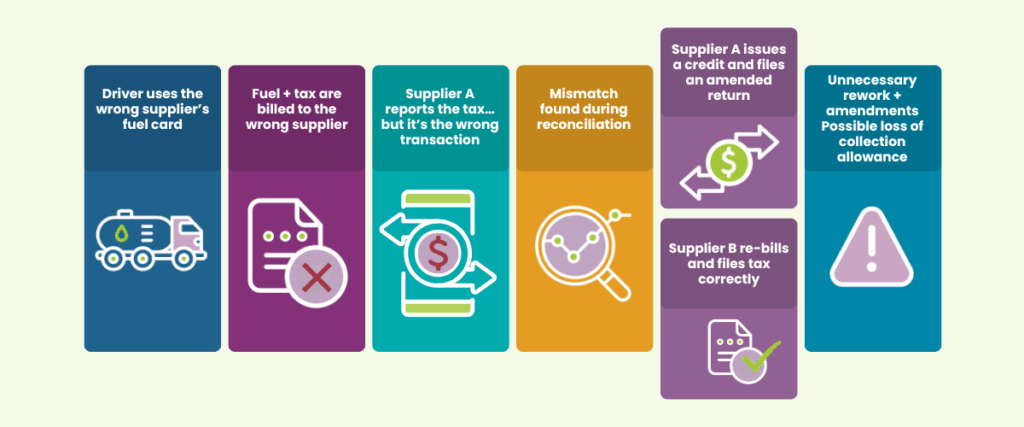

Suppose a driver picks up fuel using the wrong supplier’s card at the terminal. The transaction is billed and the tax is reported by the incorrect supplier. When the error is discovered, the supplier must issue a credit to reverse the invoice and file an amended tax return. The correct supplier then issues a new invoice and reports the tax properly. This simple mistake leads to extra work, amended filings, and unnecessary administrative costs. You could also lose a collection allowance, missing out on extra money.

How to Avoid and Manage Credits and Rebills

While eliminating every potential error is impossible, implementing robust processes and leveraging technology can significantly reduce the frequency and impact of credits and rebills.

1. Enhance Driver Education and Procedures

Your drivers are on the front line of every transaction. They are also a common source of the errors that lead to credits and rebills. Clear communication and ongoing training are your first line of defense.:

- Standardize Procedures: Establish clear, standardized procedures for fuel pick-ups at the terminal. This includes verifying the correct supplier card, confirming the product code, and ensuring the destination is correctly entered.

- Communicate Clearly: Ensure drivers understand the financial and administrative consequences of using the wrong account or card. When they recognize how their actions impact the entire supply chain, they may be more likely to be diligent.

2. Maintain Accurate and Centralized Licensing Data

Expired or missing tax licenses are another frequent cause of credits and rebills. A customer may be charged tax on a purchase, only to later produce a valid license that exempts them from that tax. This forces you to issue a credit for the tax and rebill the transaction.

A centralized system for managing customer licenses ensures that your billing system always has access to the most current information. Automated license verification tools can flag expired or invalid licenses before a transaction is even completed, preventing the need for corrections down the line.

3. Leverage Diversion Registries

A fuel diversion occurs when fuel is picked up with an intended destination but is rerouted to a different state or location mid-journey. This changes the tax liability of the transaction, as excise tax is owed to the jurisdiction where the fuel is ultimately delivered.

- Subscribe to a Registry: Electronic diversion registry, like Fueltrac, provides visibility into when and where diversions occur.

- Reconcile Diversions Promptly: By monitoring these registries, your tax team can identify diversions and adjust tax reporting accordingly before the original, incorrect information leads to a credit and rebill scenario, which can help guarantee accuracy and collection allowances. This proactive reconciliation approach ensures you are paying the correct tax to the correct jurisdiction from the start.

Credits and rebills are more than just accounting adjustments; they are symptoms of process inefficiencies that create unnecessary administrative work, add re-work, and increase compliance risk. By focusing on proactive measures—such as driver education, accurate data management, and strategic use of technology, your organization can minimize these costly errors.

Looking how to solve other fuel reporting challenges? Read the blog: Top 6 Pitfalls of Fuel Tax Reporting and How to Avoid Them

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert