Collection Allowances: How Timely Fuel Compliance Can Benefit Your Bottom Line

Are you leaving money on the table? In the rush to meet filing deadlines and audit requirements for excise tax compliance, one significant opportunity is sometimes left untapped: fuel tax collection allowances. When managed effectively, these allowances can directly free up additional funds that companies can reinvest in areas like technology, training, or process improvements, turning a compliance requirement into a meaningful operational benefit.

Many industry stakeholders see excise tax as a pass-through cost. In reality, collection allowances are a built-in compensation for doing the hard work of accurate and timely remittance of taxes. These allowances are a funding mechanism designed by tax authorities to compensate businesses for serving as tax collectors on their behalf. If you are operating in the complex, multi-jurisdictional world of motor fuels, overlooking these allowances is essentially forfeiting earned income.

What Are Collection Allowances in Fuel Excise Tax?

A collection allowance is a specific percentage or fixed dollar deduction that a state allows fuel licensees to take on their periodic excise tax remittance. The rationale is straightforward: the process of calculating, collecting, and transmitting excise taxes on products like gasoline, diesel, and alternative fuels imposes a real administrative burden. Recognizing this, many states reduce their payment obligation by a set amount, provided you comply with a strict set of criteria.

Organizational Culture and Mindset

In many organizations, reconciliation is framed as an administrative task rather than an essential control point. Teams grow accustomed to patching issues after the fact, especially if audits have historically been manageable. This creates a culture where accuracy is assumed rather than verified, and where, critically, leaders have no real-time visibility into tax exposure until problems surface.

For example, per Arizona Revised Statutes 28-5640, a supplier or permissive supplier that properly remits under this article may retain four-tenths of one percent of the taxes imposed by this article. The collection allowance is capped at $200,000.00 per calendar year. View all state regulations surrounding collection allowances in the FTA Motor Fuel State Book.

Unlike allowances for product loss (like shrinkage from evaporation) or discounts for prompt payment, collection allowances are solely tied to your function as an excise tax collector.

Collection Allowances vs. Other Fuel Tax Reductions

Understanding what qualifies as a collection allowance in fuel tax is vital for compliance and profitability.

- Shrinkage Allowance: Compensates for unavoidable fuel losses during transport and storage. Strictly attached to physical product loss, not the act of tax collection.

- TARE Allowance: isa deduction or refund provided to licensed fuel suppliers, importers, and wholesalers to account for volumetric losses of fuel due to evaporation, shrinkage, and handling.

- Administrative Discount: Sometimes overlaps with collection allowances, yet often relates to electronic filing or payment methods rather than tax remittance itself.

Bottom line: collection allowances reward accurate, timely excise tax collection on qualified fuel sales.

Why States Offer Collection Allowances

States depend on fuel distributors and retailers to be their tax collection partners. The administrative complexity of capturing fuel excise tax at each transaction, especially for multi-jurisdictional operations, makes this a challenging task. To incentivize timely and accurate compliance, states grant collection allowances to fuel taxpayers who:

- File timely returns accurately: Submit accurate fuel excise tax reports on or before the due date.

- Remit excise taxes promptly by paying the correct liability within statutory windows.

- Maintain proper licensure: Hold valid fuel distributor, supplier, or retailer excise tax licenses in each jurisdiction and for every fuel type sold.

Missing a due date, having credits and rebills, or having an expired license is grounds for immediate forfeiture of eligibility.

Navigating State-by-State Complexity in Fuel Tax Collection

One of the most persistent operational challenges for multi-state fuel companies is state-by-state differences in excise tax collection allowance rules.

- Rate Variance: States may allow a deduction equal to a percentage of tax owed (e.g., 1% of diesel fuel excise) or a flat dollar value per period.

Monthly/Annual Caps: Nearly all states impose a cap, if they offer a discount, to prevent outsized claims by high-volume filers.

Jurisdictional Nuances: Definitions of eligible transactions, fuel types, or taxpayer types (distributor vs. retailer) vary widely.

Trying to manually keep up with every state’s rules often leads to costly mistakes—either leaving money on the table through under-claimed allowances or triggering audit exposure by over-claiming.

Quantifying Impact: Fuel Excise Scenarios

Let’s see how this plays out for motor fuel excise tax specifically.

Example: A Regional Distributor with Steady Volume

Background:

A licensed distributor supplying several convenience store chains across one state move about 500,000 gallons of gasoline per month. The state’s excise tax rate is $0.30 per gallon, and distributors receive a 1% collection allowance, capped at $2,000 per month.

Calculations:

- Tax liability: 500,000 × $0.30 = $150,000

Allowable deduction: $150,000 × 0.01 = $1,500

Annual impact: $1,500 × 12 = $18,000

What it means in real life:

That $18,000 doesn’t sound massive, but for a small to mid-size distributor, that could allow tax professionals to attend various conferences where they can expand their knowledge and maintain a network of colleagues, or offset the investment in tax compliance software. Keeping compliance accurate ensures they don’t lose that allowance to audit findings or late filings. We explore more ways to optimize collection allowance below.

Maximizing the Value of Collection Allowances

Successfully claiming your fuel tax collection allowances is more than just a compliance win; it’s an opportunity to create tangible value for your business. Once you have a process to consistently recover these funds, the next step is to reinvest them strategically. By treating these savings as an asset, you can turn a routine tax function into a driver of growth and efficiency.

Here are some practical ways to put those funds to work:

- Upgrade Your Technology: Invest the savings directly into advanced tax compliance software or automation tools. This creates a powerful cycle where the funds recovered help to further streamline operations, reduce manual errors, and secure future allowance claims with even greater accuracy.

- Fund Employee Development: Use the extra capital to send your tax team to industry conferences, like FTA, or enroll them in specialized training programs. A more knowledgeable team is better equipped to navigate complex regulations, leading to improved compliance and a stronger bottom line.

- Offset Operational Costs: Apply the funds directly to essential operational expenses, like covering licensing fees; these allowances can provide a welcome revenue boost.

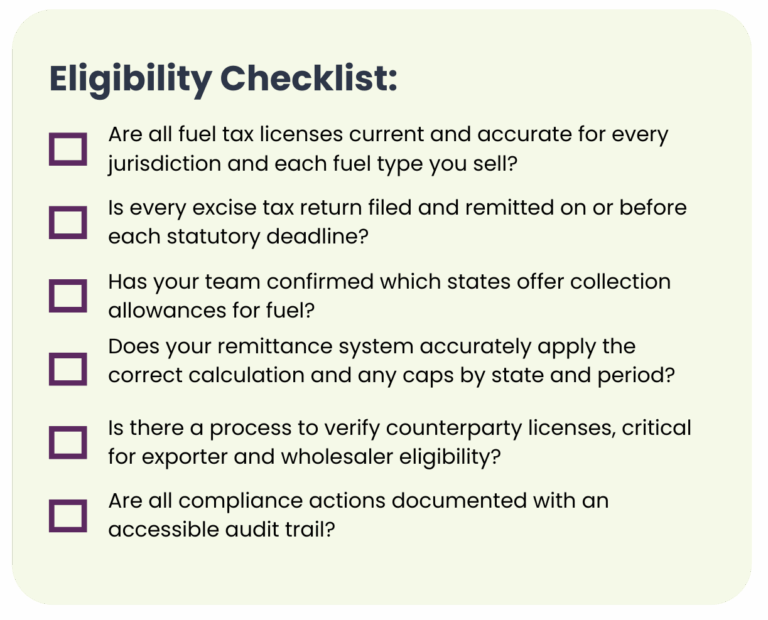

Eligibility Checklist: Is Your Operation Leaving Excise Revenue Untouched?

Fuel excise tax departments should regularly audit against these practical criteria:

If any answers are “no,” money may be left on the table due to inattention, manual error, or incomplete system logic.

Automating Collection Allowance Recovery in Fuel Excise Tax

Purpose-built tax determination engines designed for fuel excise tax can do what manual approaches cannot:

- Detect Eligible Transactions: The engine references up-to-date, jurisdiction-specific excise tax collection rules for each sale or remittance.

- Topco realized real benefits from automating its excise tax compliance. “IGEN has a smart enough system here that it realized we qualified for a discount if we filed on time, which was not being applied through our old tax software,” said LaPorte. “We are still in the works of recouping the last eight years of this, if possible.”

- Calculate per Line: Each transaction is assessed using the state’s exact allowance rate and cap, capturing all available discounts and collections with zero manual intervention.

- Audit and Report: Every deduction is annotated, with rule sources and eligibility tracked for future audits.

- Instant Updates: Regulatory shifts, such as an updated rate or rule, are immediately reflected in automatic calculations.

This level of automation means fuel finance teams are consistently claiming every dollar permitted and maintaining bulletproof compliance documentation.

Collection allowances in fuel excise tax are designed to compensate you for the essential, time-consuming task of tax collection and remittance. Yet compliance teams too often focus only on risk, not on tax operations optimization . By automating the identification and calculation of every available allowance across all jurisdictions and fuel types, you can improve transparency, reduce errors, and leave no cash on the table with no added headcount.

Don’t leave money on the table. Start optimizing your fuel excise tax compliance today with a purpose-built tax engine.

This analysis is intended for informational purposes only and is not tax advice. For tax advice, consult your tax adviser. See the full disclaimer here.

Bob Donnellan

Motor Fuel Tax Subject Matter Expert